The form to apply for this has now been published: Link

Turn back time and buy AP in the Final Salary Scheme

Up until this point we have been told to complete the old form and include a covering letter requesting the application be taken for additional pension (AP) to be purchased in the final salary scheme during the remedy period.

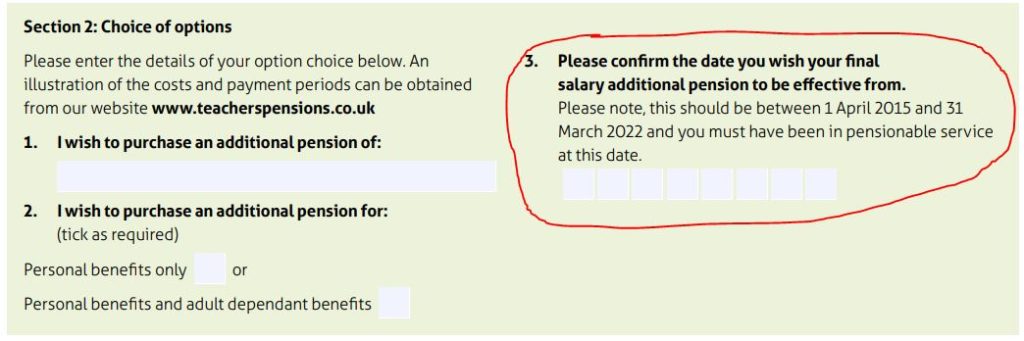

Before I start going into the details of this there are some parts which are not completely clear and so I must warn you that the figures may not give a true and accurate picture. However, the figures I do have are from an application made for retrospective AP. This date is asked for on the new application form in Section 2

I am going to assume that the “Pension Increase” will be applied from the date that the additional pension (AP), however this is not certain to be the case as the letter I have seen says this: “Your Additional Pension increases in value from the date of your full payment to your retirement date in line with pension increase factors.“

I am basing my assumption though on the fact that the payment requested does include an element of interest based on the time that has passed since the date asked for in Section 2 above. I don’t believe you can charge interest on something if you then take the date of the payment as the basis for applying the value of what has been bought.

Figures for 2016 – 50 Year Old

AP has to be bought in blocks of £250 but for the purposes of this post I will look at purchasing 4 such blocks, totalling £1,000. The date for this to be taken as 2016. I will also include the purchase of family benefits (50% to a partner etc)

£1,000 of FS AP (2016) would cost £16,080. Interest charged £1,382.

My Analysis

The interest for nearly 8 years is only 8.59%, that’s a simple annual interest rate of somewhere between 1.0% and 1.3%. That “feels” like good value.

Pension Increase: from 2016 to 2024 the inflation rate is in the region of 31.87%. If this is applied to the £1,000 then it would be worth £1,318.70 now.

Age to recover the investment

If the Pension Increase is applied from the elected date of purchase, which I believe it should, then dividing the cost (£17,462) by the current value (£1,318) gives us 13.3 years.

Taken at 60 that would be by 73.3.

If I am wrong about the way the PI is going to be added then it wold take 17.5 years to recover the investment, so by the age of 77.5

Compared to buying AP in the CA scheme now

The question here then, is it better to buy retrospective FS AP or to buy AP in the current career average (CA) scheme. For this comparison bear in mind that a 50 year-old in 2016 would now by 57/58.

A 57 year-old buying £1,000 of CA AP (2024) with family benefits would pay £15,160. That would take them 15.2 years to recover that investment. However, this AP would only be paid, in full, if they started taking it at 67.

67 plus 15.2 means they would get their investment back at the age of 82.2

I would suggest, therefore, that if you are considering the purchase of additional pension then it would be far better value to make an application for the retrospective purchase of AP from the remedy period than to buy it in the current career average scheme.

Hi David, once again great work and pretty crazy that there isn’t more clarity on this from TP. Do you have any idea how to get a definite answer to the question of when interest is added to the extra pension purchased? That decision going the way it logically should, would you suggest opting for the earliest date, April 2015, as the best choice for extra pension, or is there more to it than that? My birthday is mid march and i’m in my 40s… presumably buying this asap is the best way as with most things pension?

The key eligibility for this is that you have to be able to demonstrate that you would have bought it at that time. Putting 1 April 2015 would have me, if I was running this, asking you why didn’t you do it on 31 March 2015 when you were still able to do s

Hi David

IS the 31st March 2024 the last chance to apply for this, as is the case with the other Flexibilities?

Thanks

No, you have up to 6 months from the date you are sent your REMEDIABLE service statement – not the current ROLLBACK statement

Hi David, thanks for all the info you share with us all, I’m very grateful 🙏.

Am I correct in thinking that you only get an RSS when you apply for your pension? If so, does this mean that as I won’t be taking my pension for a few years yet, the Retrospective Additional Pension in the Final Salary scheme is not an option for me?

Thanks, Emma

At the moment almost all of those who have received their RSS are those who are applying for retirement, BUT, the legislation states that EVERYONE must be sent their RSS by April 2025.

Even without an RSS the TPS are accepting applications for retrospective AP purchases.

Thanks David. One more question then, how do I find out how much it will cost me to buy the additional £250 blocks? If I’ve understood correctly this is age dependent and the age in your example doesn’t work for me.

Thanks, Emma

Yes, tricky. They have removed the calculator for the FS option from the website. They won’t tell you until you apply!

Roughly though you can use the current calculator on their website, for the CA pension, and multiply the cost it give you by 1.43

Thanks for this – it’s very useful. I’m trying to decide if I should do buy retrospective Additional Pension Purchase or not. I’ve been in TPS since 2007 and I’m currently 51. Always worked PT but planning to go full time for the next few years. If I purchase (retrospective) Additional Pension in the Final Salary Scheme will I still be able to choose Career Average for the rest of the pension if it works out better?

Or should I get an AVC with a private provider? Would that have advantages?

Any pointers would be much appreciated.

This is something that steps outside my expertise, I cannot give you advice as to what would be the “best” investment.

Yes, buying retrospective AP does not prevent you from going with the CA option when you retire should that be your preference.

Thanks David, very helpful!

Thank you for your helpful advice. I’ve just submitted a form to the TPS to see how much it would cost me for £1000 worth of pension backdated to April 2015. Do you know if it’s possible to do this more than once ? (eg could I then buy more later or would it all have to be done at once). Also thank you for your helpful video about getting the tax back.

You can apply for those periods where you WOULD have bought it had you not been discriminated against and prevented from doing so. That means you should be able to start the purchase of it many times in that period. The form does suggest you have to pay with a lump sum, but following complaints that have been escalated to the DFE the TPS have agreed that you can ask for a monthly plan to make the purchase. To do that you would have to include a letter making that request and laying out the number of years you want to make the payments over.

Thanks for all this David. Do you have a link to the DFE escalation. I would like to link and quote in my letter.

I bought additional pension commencing Dec 22, just outside remedy period. Would I be able to apply for retrospective additional pension?

So long as you have Transitional Protection and were moved into the CA scheme before April 2022 then, yes, you can.

One final question, what difference does the date in section 2 make?

It is the date that you believe you WOULD have started buying Additional Pension if you had still been in the Final Salary scheme at that time.

Indexation should be applied from that date and the costs will be based on your age at that time.

Sorry to be a numpty about this. Is there a really simple explanation eg what is Retrospective Additional Pension Purchase and who can apply please?

Additional Pension – you hand over a large sum of money now and they promise to pay you regular sums in the future.

The amount they promise to pay you will increase by inflation each year.

The “large sum” depends on how much you want to buy and how old you are.

The “retrospective” part means you get to apply as though you were a lot younger – as far back as 2015, so up to 9 years younger.

Your are allowed to do this if you have “transitional protection” and would have bought it at the time if you had not been, illegally, moved into the Career Average scheme at that time.