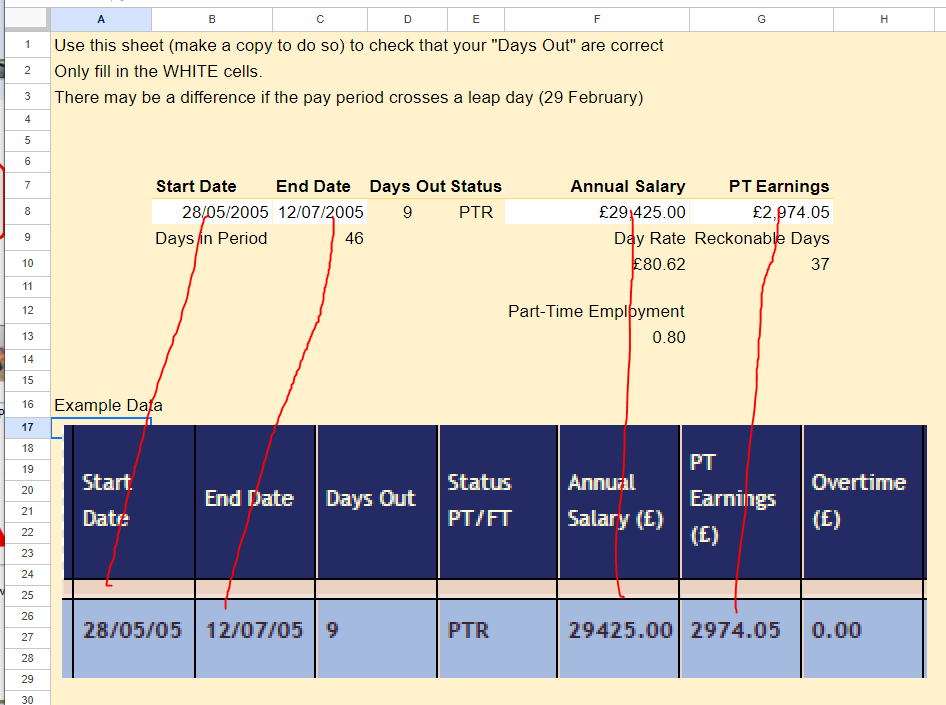

After fielding a number of queries regarding the days out and how they are recorded for part-time teachers I created this sheet to allow teachers to check their figures:

https://docs.google.com/spreadsheets/d/1zel8OQaROLesBE-mXGzH3q0tOzuv6WgjioXq75l0aS0/edit?usp=sharing

The way that part time work is recorded is not very intuitive and I sympathise with them. After all if you work 4 days a week then in a month you are likely to miss working on 4, or at the most 5, days in that month…so how come the statement shows 6 “days out”…there aren’t that many “Mondays” in ANY month!

To understand how part time service is recorded requires a different approach than just looking at the actual days you work in a week, we need to go much wider than that.

A full time teacher may work 5 days a week and they do that for 39 weeks in a year, that is 195 days, but their service record for a full academic year is recorded as all 365 days in the year (even in a leap year!)

In order for a part time worker to be credited with the correct proportion of the pension, i.e. 80% for one who works 4 days a week, that proportion is applied to each pay period. In a full academic year then a 0.8 part time teacher should get 0.8 x 365 days credited to their service record.

0.8 x 365 = 292 days. This is recorded by having the rest of the year, 73 days, labelled as “days out”.