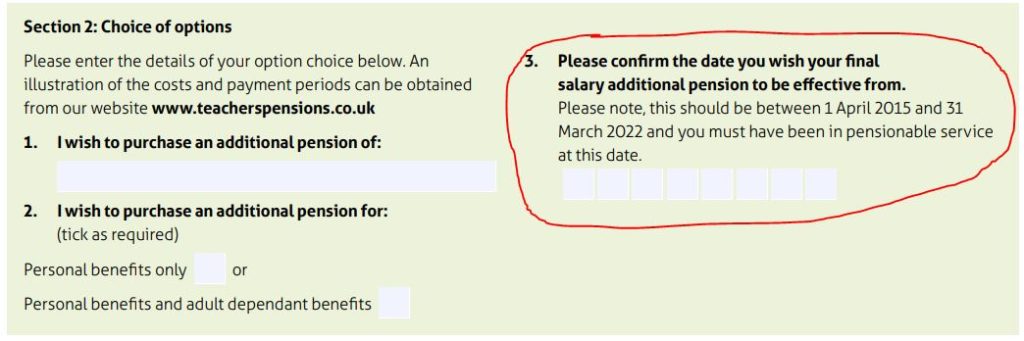

The form to apply for this has now been published: Link

Turn back time and buy AP in the Final Salary Scheme

Up until this point we have been told to complete the old form and include a covering letter requesting the application be taken for additional pension (AP) to be purchased in the final salary scheme during the remedy period.

Before I start going into the details of this there are some parts which are not completely clear and so I must warn you that the figures may not give a true and accurate picture. However, the figures I do have are from an application made for retrospective AP. This date is asked for on the new application form in Section 2

I am going to assume that the “Pension Increase” will be applied from the date that the additional pension (AP), however this is not certain to be the case as the letter I have seen says this: “Your Additional Pension increases in value from the date of your full payment to your retirement date in line with pension increase factors.“

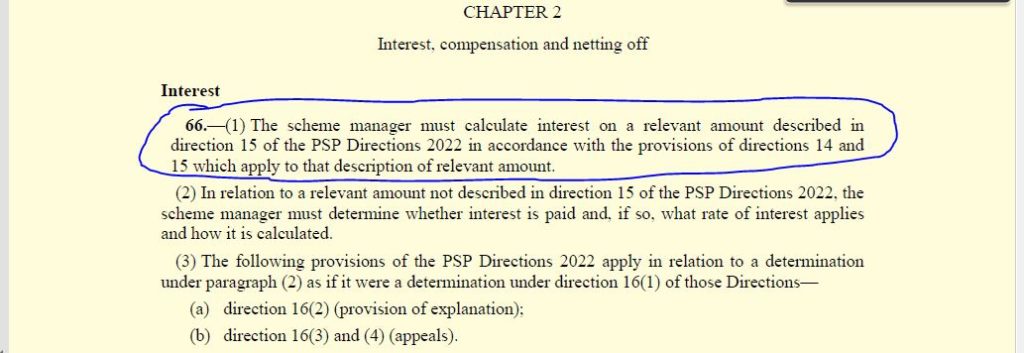

I am basing my assumption though on the fact that the payment requested does include an element of interest based on the time that has passed since the date asked for in Section 2 above. I don’t believe you can charge interest on something if you then take the date of the payment as the basis for applying the value of what has been bought.

Figures for 2016 – 50 Year Old

AP has to be bought in blocks of £250 but for the purposes of this post I will look at purchasing 4 such blocks, totalling £1,000. The date for this to be taken as 2016. I will also include the purchase of family benefits (50% to a partner etc)

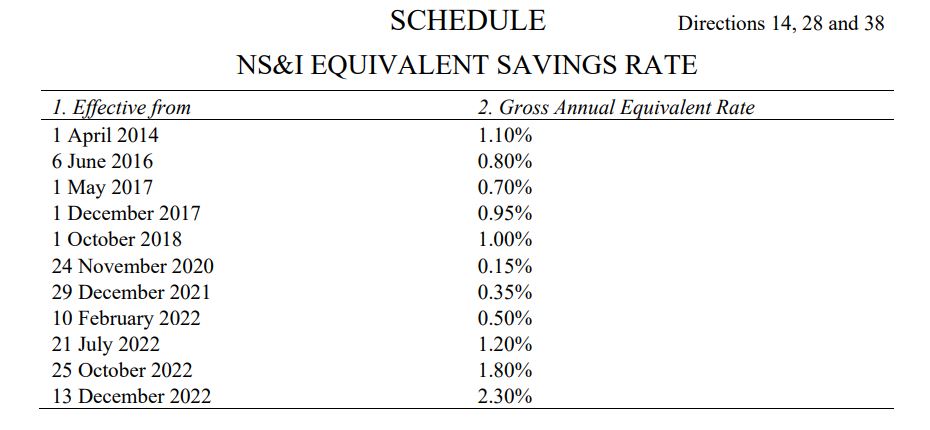

£1,000 of FS AP (2016) would cost £16,080. Interest charged £1,382.

My Analysis

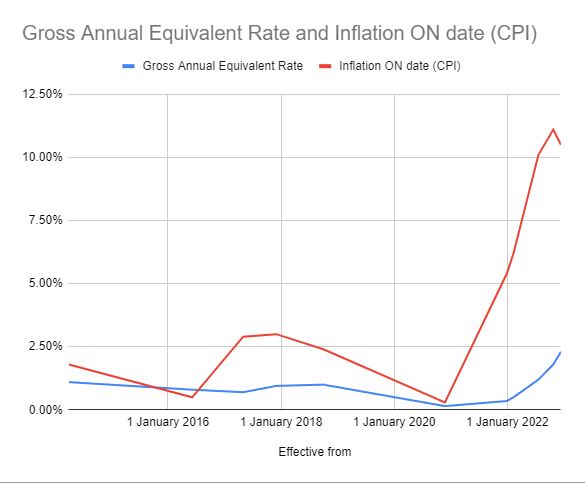

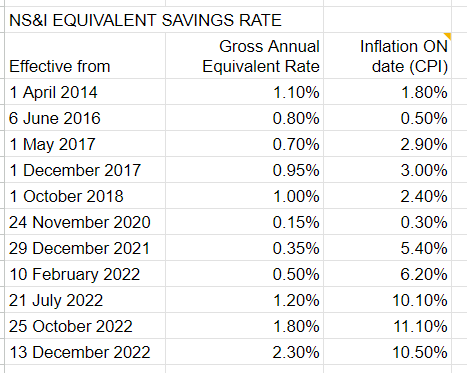

The interest for nearly 8 years is only 8.59%, that’s a simple annual interest rate of somewhere between 1.0% and 1.3%. That “feels” like good value.

Pension Increase: from 2016 to 2024 the inflation rate is in the region of 31.87%. If this is applied to the £1,000 then it would be worth £1,318.70 now.

Age to recover the investment

If the Pension Increase is applied from the elected date of purchase, which I believe it should, then dividing the cost (£17,462) by the current value (£1,318) gives us 13.3 years.

Taken at 60 that would be by 73.3.

If I am wrong about the way the PI is going to be added then it wold take 17.5 years to recover the investment, so by the age of 77.5

Compared to buying AP in the CA scheme now

The question here then, is it better to buy retrospective FS AP or to buy AP in the current career average (CA) scheme. For this comparison bear in mind that a 50 year-old in 2016 would now by 57/58.

A 57 year-old buying £1,000 of CA AP (2024) with family benefits would pay £15,160. That would take them 15.2 years to recover that investment. However, this AP would only be paid, in full, if they started taking it at 67.

67 plus 15.2 means they would get their investment back at the age of 82.2

I would suggest, therefore, that if you are considering the purchase of additional pension then it would be far better value to make an application for the retrospective purchase of AP from the remedy period than to buy it in the current career average scheme.