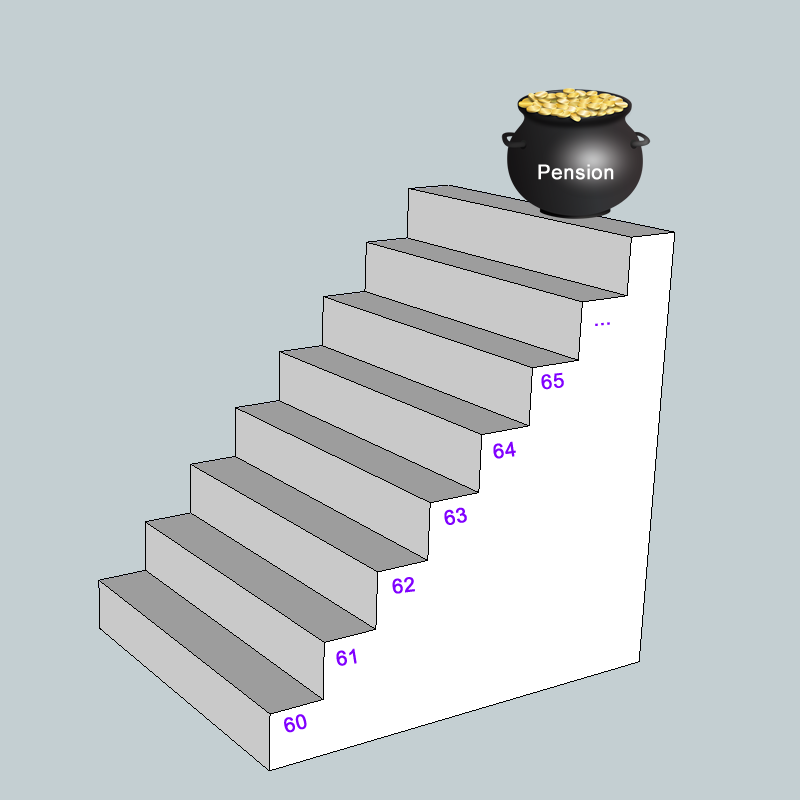

Taking the pension “early” requires a break in employment…but how long a break?

The Regulations

https://www.legislation.gov.uk/uksi/2010/990/made/data.pdf

The Pension scheme lays down very clearly how long a break is needed in order to take the pension before you reach you Normal Pension Age:

The Schedule in the regulations that covers taking “Early” retirement starts on page 121 and is called “Case E”

Case E: early retirement with actuarial adjustment

Page 121, Case E (10), https://www.legislation.gov.uk/uksi/2010/990/made/data.pdf (The Teachers’ Pensions Regulations 2010)

10.—(1) A person (P) falls within this paragraph if—

(a) P was in pensionable or excluded employment at any time after 29th March 2000,

(b) P ceases to be in such employment,

There are other parts to this regulation but the key part above is that you have to “cease” to be in employment. This is then expanded on to explain what is meant be “ceasing” in regulation 14, shown below:

For the purpose of this Schedule—

Page 122, Case E (14), https://www.legislation.gov.uk/uksi/2010/990/made/data.pdf (The Teachers’ Pensions Regulations 2010)

14 (a) a person is not to be treated as ceasing to be in pensionable or excluded employment unless at least one day passes without the person being in such employment after the person ceases to be in such employment;

Simply put, you can take the pension early so long as you are not employed as a teacher ON the day you have asked for the pension to begin.

School Policies

Unfortunately many schools and LAs get confused over what is a break in employment, using what is needed to reset other employment rights and not what is needed for an employee to take their pension. There is no legal barrier to an employer ending, with the agreement of the employee, a contract of employment on one day and starting a new contract after a gap of 24 hours.

A number of schools HR departments are rather lazy in this regard and instead of just doing what is required to enable the employee to take their pension insist on a longer break because of their misunderstanding of what is needed to constitute a “break” in employment. This is often based on other employment rights, such as avoiding having to repay redundancy payments, or entitlement to sick pay etc.

Unfortunately, if they do insist on a longer break there is very little the teacher can do in such circumstances since they are over a barrel as they do need the break in employment in order to start taking the pension before their normal pension age.

This is NOT the case for teachers who have already reached their scheme’s normal pension age. They can start payment of their final salary pensions simply by opting out of the pension scheme without needed any break in employment.