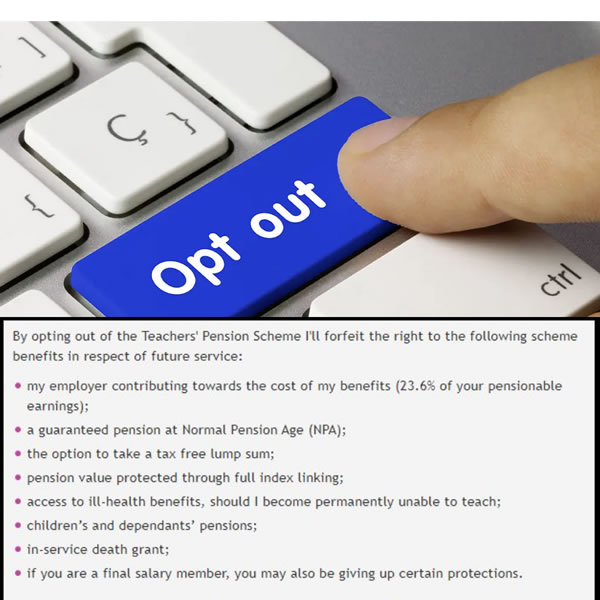

The WARNING!

When you go to opt out you get “warned” about doing this with a list of what they consider the dire consequences…bear in mind that this list is aimed at those who are thinking about opting out of the pension scheme for good and not those who are looking to “lock in” a good set of salaries that could soon become too old to be used and may be lost forever without such action. Opting out to invoke the protective hypothetical calculation is not the same as leaving altogether.

However, the warnings do worry people – that is the intention, after all, to make those thinking about leaving, pause for thought. There are some parts that are relevant but here I go through each of the points being made.

| my employer contributing towards the cost of my benefits (23.6% of your pensionable earnings); | 1) Employer contributing 23.6%. It doesn’t matter how much they contribute. The calculation of your final salary is based on rules and not on how much money is paid into the scheme. Opting out to use the hypothetical calculation “rule”, to stop the value falling is the point of doing this. It is one of the most counter-intuitive rules that means you can get MORE by paying in LESS (one month less). But it is a rule and there to be used if you are aware of it. (oh and it is rising to 28.6% in April 2024 – but it still doesn’t matter) |

| a guaranteed pension at Normal Pension Age (NPA); | 2) Guaranteed Pension at NPA You do not forfeit your right to what you have already bought and paid for in the scheme. Indeed what you are doing is locking in what you hope is likely to give you a BETTER guaranteed pension, at the same NPA. (Opting out for a single month means you come back into the same scheme you would have been on if you hadn’t opted out. Only a break of more than 5 years can change that, AND only if they changed the scheme during that break) |

| the option to take a tax free lump sum; | 3) Tax-free Lump Sum entitlement Unless they change the rules of the scheme this doesn’t happen. Again you would have to be out for more than 5 years and the change happen whilst you were out. |

| pension value protected through full index linking; | 4) Pension value protected through index linking. Yes, this is the whole point of opting out, to lock in what have turned out, already, to be HIGHER valued salaries from the past before they get to old to be used. Indeed, opting out, for just one month, is protecting the pension’s value – it is staying in, without a break, that could lead to a loss of value if your best salaries get too old to be used in the calculation of the pension. |

| access to ill-health benefits, should I become permanently unable to teach; | 5) Access to ill-health benefits. YES, this one has some merit and is the reason why many suggest taking out extra insurance for the month you are out of the scheme. However, note that you do not “lose” those benefits permanently, they are restored, in full, upon re-joining the scheme. Note also that for your to become so suddenly ill during a single month out that you were fully incapacitated would be highly unusual. You get 6 months full sick pay and 6 months half sick pay, so unless you are already exhausting your sick pay entitlement it would be highly unusual for you to suffer a loss in this regard during a single month out. |

| children’s and dependants’ pensions; | 6) Dependent’s Pensions YES, again, this one has some merit and the point about insurance above applies. Dependent pensions, those given when you die, are much better if you are “in” the scheme at the time you die. The pension is enhanced by adding on half of what you would have added to the pension between the date of your death and your state pension age. Then a partner would get 37.5% of that and dependent children up to half what the partner would get. |

| in-service death grant; | 6) Death Grant YES, same as above, if leaving money to your heirs is important then consider taking out extra insurance. |

| if you are a final salary member, you may also be giving up certain protections. | 7) Final Salary Benefits This ONLY applies if you are out of the scheme for more than 5 years. The benefit referred to here is being able to use future salaries in the calculation of the final salary pension. Being out for a single month has NO impact. Also, given that you are opting out because the salaries from 8 to 10 years are are better than your current salary it would take some significant pay rises in the future for your future salaries to catch up and then overtake the ones you are locking in anyway! |

Hi, thank you for the above info. I have a related question that comes from an enforced leaving of the TPS. I wondered if you would be kind enough to share any guidance you might have on it…

———————————–

MY QUESTION IS: What percentage increase would be fair to ask for to replace the defined benefit from coming out of the TPS?

Specifically in my case: £49,000 + TPS = £49,000 + £?? + Aviva Pension

—————————————

I have moved schools to take up an equivalent teaching role elsewhere. My old school was a part of the TPS and the new one is not. I have been offered the job but have not yet accepted in writing. I am excited about the new role but am concerned about the relative value of the employment offer given this change in pension type.

–> My previous job had a salary of £49,000 + TPS

–> My new job offer is the same £49,000 salary but with an Aviva APTIS pension (Defined contribution scheme where I contribute 6%, the employer contributes 16.7%).

Overall I am pretty sure this new offer is less valuable in the long term, but by how much? To bridge the gap in the pension offering I would like to try to negotiate a % age increase in my newly offered salary, and use this extra as an automatic regular additional contributions to my Aviva pension.

My question therefore is how much extra should I reasonably ask for?

I am looking for a sum to cover the money aspect only. Obviously some of the additional benefits of TPS (death in service etc) cannot be directly compared with APTIS. Nevertheless I hoped you might be able to help me with some kind of estimate of an percentage figure I could reasonably propose to my prospective employer to make the new employment offer equivalent.

I hope that makes sense and thank you for your help

(Age 37. Plan to retire at approx 63)

I think what you have been offered is the same as is being given to the others in your school. When phased withdrawal was introduced many schools offered the amounts they were paying into the TPS at that time. So, whilst the current figure paid into the TPS is 28.68% I doubt you will find any private school willing to match that – however it is a pay negotiation and so you may push for a higher wage, which in turn would increase the amount paid into the pension.

I’ve just opted out and must admit after 32+ years it does feel scary and unprotected, never mind the dire warnings! (but I did read your post before I filled the form, and it was reassuring).

As a part-time worker (0.6) my pension benefits accrue more slowly: does that mean I need to opt out for two months rather than one?

Many thanks for everything you do – I find the videos and spreadsheets especially helpful.

No, one month is fine

Hi Dave,

Thanks for the really useful information. I am now considering opting out for a month to lock in my final salary benefits, as the private school I work at is planning on taking their extra employer contribution costs out of future pay awards.

I have also been paying towards additional pension under the final salary scheme for several years and have just opted to buyout 3 years from my CA pension. Do you know if those options will automatically continue when I opt back in, or even be available to me?

Thanks,

Neal

You will need to contact the TPS and ask to resume them. They may not offer this for the AP but should give you the option to pay for the remaining part that you have not yet completed.

Bear in mind that the cost for AP has risen sharply recently.

You should be eligible to apply to buy retrospective AP if you were moved into the CA scheme prior to April 2022.

Hi Dave,

Thanks for setting up this site – it has some really useful information about teacher pension stuff you just don’t think about, when we really should!

Last January, I stepped down from my senior teacher role that I had been in for approximately 20 years, and am now purely a classroom teacher. I am approaching 50 this year, and although I know I could afford to take this step now I hadn’t really explored all of the pension implications of the TPS. I think that if I work much beyond 55 it will have a significant impact on my pension due to the lower final salary that I will be on. Have I understood correctly that I could control this by opting out for a month so that I lock in my higher final salary? How does this work please?

I explain this here: https://youtu.be/qP5XkqTM1f8

Thanks Dave, that’s great!

I am so glad to have come across this site in the nick of time for me. It is so informative so thank-you for doing all this work. Its brilliant!

I am about to opt out this month to protect my best three years’ salary (Sept 2014-Aug 2017) but my HR department has said it is only one day opt out required. I am now in a panic having read about it being a month; does it need to be a full month?

You need a break of anything up to 5 years to put in place the protective calculation. Your HR are correct in saying you only require a break of a single day in order to get this protection, unfortunately the scheme rules only allow this if you leave employment for that day. Opting out, by the pension scheme’s rules, has to be for a minimum of one calendar month.

Thank-you so much. I am so glad I came across your site. I have informed my HR team. I didn’t understand that bit and it would have cost me thousands of pounds otherwise. Really useful to know. Thank you so very much.