How it works.

The question was, how long do you have to pay when you sign up for the Early Buy Out option.

Forever, or as long as you want, is the answer

Let me explain how it works.

Every month you add a bit to your pension (1/57 of that month’s salary).That bit will pay out when you claim your pension, being paid every year for the rest of your life, but will be reduced if you take it early.

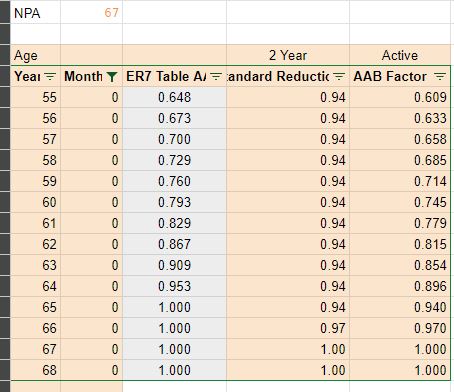

The reduction is based on your age.This reduction is done in two parts because it is based on the State Pension Age (SPA) and people have different SPAs.

The earliest SPA is 65. If your SPA is later then 3% more reduction is applied for each year later your SPA is than 65. It is this latter 3% reduction that you can “buy out”. You can only buy out the number of years between 65 and your SPA.

If you take the pension at 55 then the reduction factor from 65 is 0.648.If your SPA is 67 then a further 0.94 factor is applied (2 lots of 3%).

Example. An unreduced pension of 10,000.

- Taken at 55 without any buy out:£10,000 x 0.648 x 0.94 = £6091.20

- Taken at 55 with buy out of 2 years:£10,000 x 0.648 = £6480.00

HOW LONG YOU PAY FOR

In just the same way that you add a bit every time you are paid to the pension if you elect to buy out you pay a bit more for the advantage of the buy out. Every month.

What happens is that the “bit” you add to your pension in that month will get the advantage if, at the same time, you paid extra for the buy out.

If you stop paying for the buy out then whatever you add to the pension in the next month won’t get the benefit. However, all the amounts you did pay for earlier will still get it.

Example. You pay for the buy out on the first £5,000 that is added to your CA pension. You then go on to add another £5,000 without paying for the buy out.

So you have £5k with and £5k without.

The calculations then for taking it at 55 are a mix of the two I put earlier, thus:

- £5000 x 0.648 x 0.94 = £3045.60

- £5000 x 0.648 = £3240.00

Total Pension: £6285.60

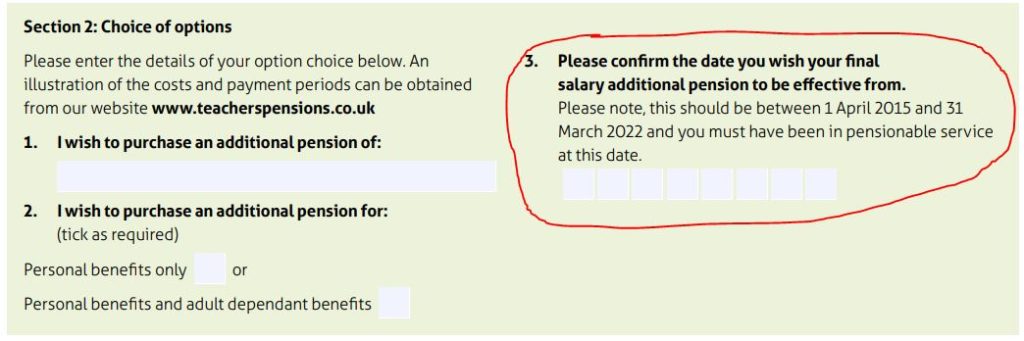

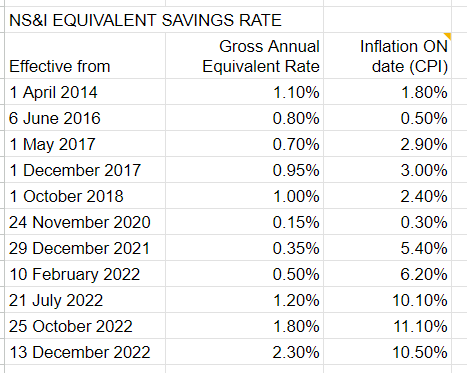

This image shows the factors and combined factor for different ages based on someone with an SPA of 67 buying out 2 years.