How it works.

The question was, how long do you have to pay when you sign up for the Early Buy Out option.

Forever, or as long as you want, is the answer

Let me explain how it works.

Every month you add a bit to your pension (1/57 of that month’s salary).That bit will pay out when you claim your pension, being paid every year for the rest of your life, but will be reduced if you take it early.

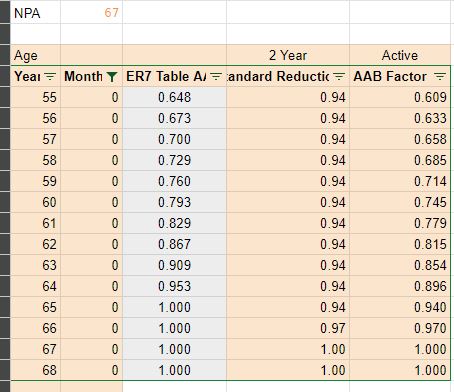

The reduction is based on your age.This reduction is done in two parts because it is based on the State Pension Age (SPA) and people have different SPAs.

The earliest SPA is 65. If your SPA is later then 3% more reduction is applied for each year later your SPA is than 65. It is this latter 3% reduction that you can “buy out”. You can only buy out the number of years between 65 and your SPA.

If you take the pension at 55 then the reduction factor from 65 is 0.648.If your SPA is 67 then a further 0.94 factor is applied (2 lots of 3%).

Example. An unreduced pension of 10,000.

- Taken at 55 without any buy out:£10,000 x 0.648 x 0.94 = £6091.20

- Taken at 55 with buy out of 2 years:£10,000 x 0.648 = £6480.00

HOW LONG YOU PAY FOR

In just the same way that you add a bit every time you are paid to the pension if you elect to buy out you pay a bit more for the advantage of the buy out. Every month.

What happens is that the “bit” you add to your pension in that month will get the advantage if, at the same time, you paid extra for the buy out.

If you stop paying for the buy out then whatever you add to the pension in the next month won’t get the benefit. However, all the amounts you did pay for earlier will still get it.

Example. You pay for the buy out on the first £5,000 that is added to your CA pension. You then go on to add another £5,000 without paying for the buy out.

So you have £5k with and £5k without.

The calculations then for taking it at 55 are a mix of the two I put earlier, thus:

- £5000 x 0.648 x 0.94 = £3045.60

- £5000 x 0.648 = £3240.00

Total Pension: £6285.60

This image shows the factors and combined factor for different ages based on someone with an SPA of 67 buying out 2 years.

Hi David,

Thank you for this. It is really helpful. I have learnt so much about the Teacher’s pension from you. I wish I had the benefit of your advice when I started out.

I just want to understand what the impact then of the buy out is in terms of my pension pot when I come to retire.

I am 53 and plan to retire in August 2025 at the age of 55 as you illustrate above. My NPA is 67.

On the flexibilities calculator it says it will cost me £1291 a year for 2 years Buy Out.

So I think I understand then that the reduction of my CA pot when I retire would be my CA pot x 0.648 if I buy out 2 years rather than my pot x 0.648 x 0.94.

So could this mean I have another approx £2000 on the CA part which would mean my annual pension could be that much more (depending on if I take extra lump sum) or have I totally misunderstood ?

I guess my question is would it be worth doing as I will only be adding to my CA pot for another 18ish months.

I understand this is also paid for from April 2022 too which sounds a bit good to be true !!

Many thanks.

It could be up to 6% better….on £2000 in the pot already that amounts to a maximum extra of £120 on the annual pension.

Hi,

I am a fellow Maths Teacher nearing retirement and have been really impressed by the explanations in your videos. When originally moving across to the Career average scheme in 2017 (tapered relief) I applied for AAB Buy out. Following your videos on the Mccloud judgement I wrote to Teachers pension regarding AAB Buy out and was suprised by the response. They stated that although if you already had AAB Buy out it would be null and void from April 2022 unless you reapplied for it before 31st March 2024. I wonder what other additional benefits this policy affects due to the Mccloud judgement.Hope this makes sense.

Many thanks

Julian Rees.

We have seen letters going out that strongly imply that opting for the Buy Out will be backdated to 1 April 2022 but, interestingly, that no backdating of the contributions is going to be asked for. Implying that you get those 2 years for “free”.

Hi David

I am a 53 year old teacher planning to retire at 60. If I buy out two years from my career average pension, it will cost me approximately £840 a year and therefore £5040 if I pay it until I retire. Alternatively I have considered just relying on my final salary pension when 60 and leaving my career average until 67 when it won’t be reduced. Please can you tell me what you think of this plan?

The Buy Out is not a brilliant investment in my opinion, that is unless it gets applied to the initial two years for nothing.

I wonder if you can help.

I have bought into the AAB buyout from 2015. I have now re-joined post 2022.

However I have just read a blog on TPS that includes the following:

“No refund will be made of any Buy Out contributions if you choose to claim the career average pension before age 65.

If you left pensionable service at age 60 for example and claimed your final salary pension you would need to leave your career average pension deferred until age 65 to benefit from any Buy Out election. Your career average pension would be payable in full at age 65 rather than your State Pension Age.”

This was published on ‘Last Updated: 02/02/2024 10:46’

I have gone back through all I can find on this and have never seen this mentioned before.

My assumption was that with my buy out it would be applied pro-rata if I were to retire prior to 65. The blog above seems to suggest this is not the case and I will loose my money (it is quite a lot of money!). Reading your post, it seems that was your interpretation too.

I also have concerns about where the money paid between 2015 and 2022 has gone!!!

Thanks for your help!

Yes, this post appeared on a Friday and I complained in the afternoon, by Monday when I called they had been made aware of this issue and on Tuesday the post had been deleted!

I took my took my FS pension at 60 in August. I had a day’s break and then continued to work 0.4 paying into my CA pension.

Does this day’s break affect my eligibility for the buy out with (hopefully) the added two free years?

It should not but the TPS appear to be saying “No” when asked how you can get this.

Clearly, to my mind at least, your should be allowed to be in the position you could have been in had you not been illegally discriminated against and as such should be allowed to purchase the Buy Out with effect from 1 April 2022 to the date you leave (or have already left in your case) the scheme.

This all confuses me so much! If I am planning to retire by 60 and have a pension age of 67 for ca and 60 for FS and am currently 46, is it worth it? Will I gain anything and will I be paying the additional for buy out every year until I retire?

Hi David, like you I will have 27 years service by 01/09/2024 aged 60 (Career Average = NPA 67). I am gradually plucking up courage to hand my notice in, not easy considering the income ramifications!

My question is: At this stage is it too late to buy out 2 more years (65-67), if I can pay a few lump sums in between now and the end of August is it worth it when my career average pension is only going to be around £1800?

Thank you David for everything you are doing to support those still at the chalk face.

The deadline for applying for the buy out is today – so that’s not really an option any more since you need signatures etc from your school.

Though if you were put off by the shockingly erroneous post they put on the TPS website you could apply and complain that it was their misinformation that led to your delay in applying.