So you found a dodgy break in your history?

Over 90% of problems with the pension can be traced back to incorrect records being sent in to the administrators by employers.

The responsibility for putting errors right lies with the employer, the administrators (TPS) of the scheme have very limited powers to alter the records they have been sent, mainly only in cases where the employer no longer exists.

How to correct the problem?

Contact your employer and explain the problem and ask them to correct it.

They may be willing to do that immediately but with many employers no longer keeping records for more than 7 years you may find that they want YOU to prove that they employed you and that you were in the pension scheme.

Evidence?

PAYSLIPS: The very best evidence is your pay slips that show that the school employed you AND that you were paying into the pension scheme. The problems if often that we no longer have our pay slips and it can be many years, decades even, in the past that the problem exists.

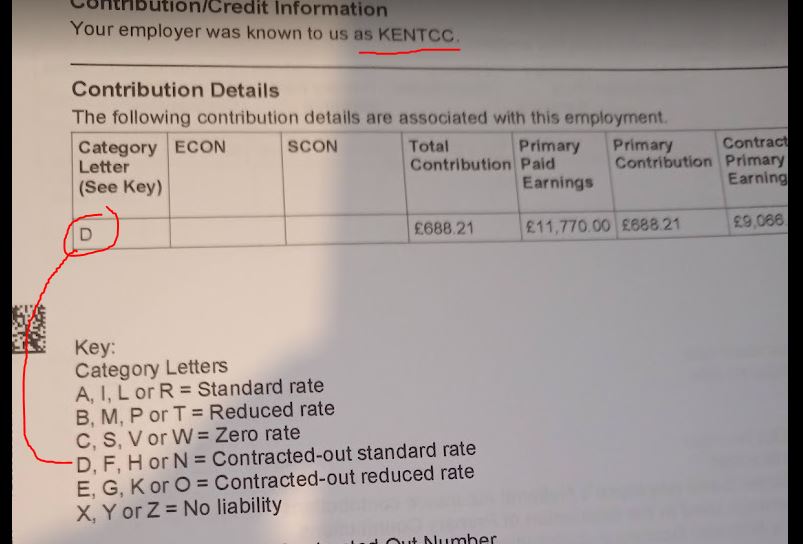

NATIONAL INSURANCE RECORDS (Pre-2016): HMRC keep records going back to the day you were issued with a number! As such you can ask them for this data and it is, for employment before 2016, very useful proof.

Before 2016 teachers who were paying into the TPS paid a special rate of National Insurance and so this is recorded by HMRC. It is called the “contracted out” rate. Ask TPS for your records of employment and the NI rate and it will show you, for periods up to 2016, both who employed you and whether you were in the TPS or not.

Look for the employer and the “Category Letter” for the employment as proof you were in the TPS

Getting your records

Make a “Subject Access Request”: https://www.gov.uk/guidance/hmrc-subject-access-request

Leave a Reply

You must be logged in to post a comment.