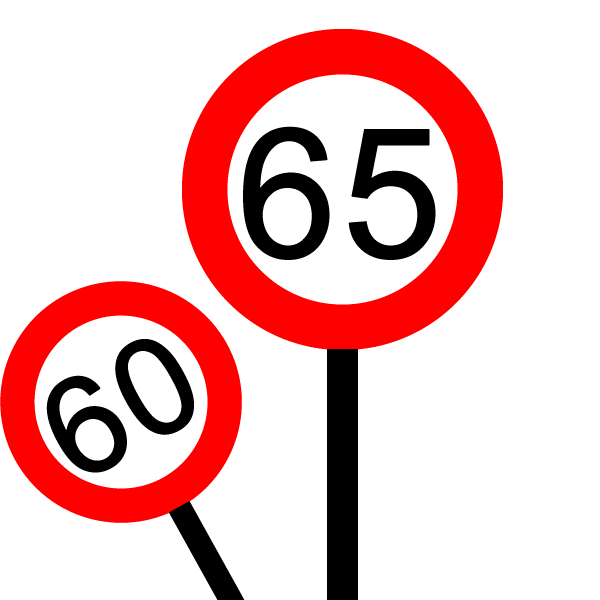

The Teaching pension schemes are no strangers to changes in the pension age at which they are designed to be taken.

Before 2007 it was 60, then 65 and more recently has been brought into line with the state pension age. What is also changing is the MINIMUM pension age – the age at which you can, with a reduction, take the pension.

The GOOD news is that as the legislation stands the final salary schemes, those that teachers were in before 1 April 2015, retain the pension ages as they were – no real surprise there as that was the contractual obligation, teachers will get what they signed up and paid for.

The BAD news is that the newer, career average, scheme was written differently and so IS subject to the change. If you are not 55 before 6 April 2028 then you won’t be able to access this part of the pension until you reach 57. Also, the plan is to raise this further in the future to 58 and for it to then track 10 years behind the state pension age. Remember though that taking it 10 years early does mean you will be paid less to make up for the fact you will be paid it for longer.