Just my collection of thoughts on ways the statement and other aspects of the TPS could possibly be improved.

- Imminent loss to final salary value

- Hypothetical calculations on statement

- Indexation updates from October

- RSS progress reporting

- Pension process – detail on task progression

- Conversion letters – use comparable figures

- Abatement warning on approaching normal pension age

- Threaded communications

- Part Time Data

- CETV Calculator

- Reset Password or Locked Out

- More Rigorous Data Validation

Highlighting when an imminent loss in value to the final salary pension is likely

Where a Method B calculation for the final “average salary” is using salaries that are about to become too old then the statement could include something to alert the teacher to this fact. Possibly colour-coding the months/years that are being lost, I would suggest red for those being lost in the next 6 months and amber for those that will be lost within 12 months.

Hypothetical Calculations

To be included on the statement, though this may be an issue of cost since every break creates a new calculation and some teachers, particularly supply staff, could have rather a lot of these.

Alternatively, including the final “average salary” that was in effect at the time of each break since this is a value critical in determining if the break is going to give rise to a “restricted” or “unrestricted” hypothetical calculation.

Indexation Increases after October

Currently the indexation figure being used for the year does not get added to the estimated pensions on the statements until the Government confirms it will use September’s CPI measure of inflation. The Government doesn’t tend to do this until the first months of the following year despite the figure being published by the ONS in October.

Given that the statements are only considered to be “estimates” there is no reason that once the inflation figure is published it could not be factored in to the calculation.

Progress reports – Transitional protection – Remediable Service Statement progress

Publishing, and then updating regularly, how many RSS’s need to be produced and the number currently distributed would give members a better understanding of the scale of the problem and appreciate how quickly it is being resolved, or not.

Progress reports – Pension applications

I would expect there to be a process that is followed rigorously when an application for a pension is made. The current task tracker lacks details on what those steps are and whether there are any sticking points.

A list of the steps with green ticks for complete, amber for steps that are waiting for 3rd party action and red for those that cannot be completed until prior steps are completed would give more reassurance that the application was being processed.

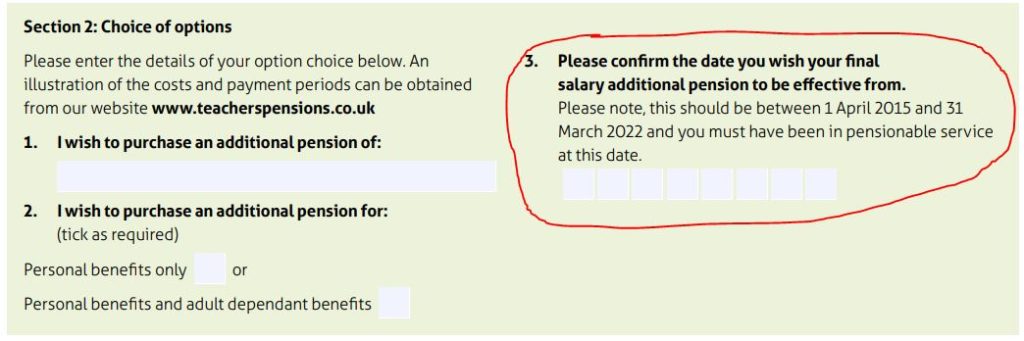

Conversion Letters – Use comparable figures

The conversion letters sent out to those who purchased extra pension in the remedy period offer compensation or a conversion to additional pension in the final salary scheme but the figures are not comparable.

The compensation is based on the value now, currently in 2024, but the conversion figures are either based on a value from April 2022, if the extra pension purchased is via Faster Accrual or the Early Buy Out, or the value from the date the original purchase of additional pension was made, potentially as far back as April 2015. The newest letters do tell teachers than indexation has to be applied from those dates but it would make far more sense to give them the valuation as of April 2024 as well.

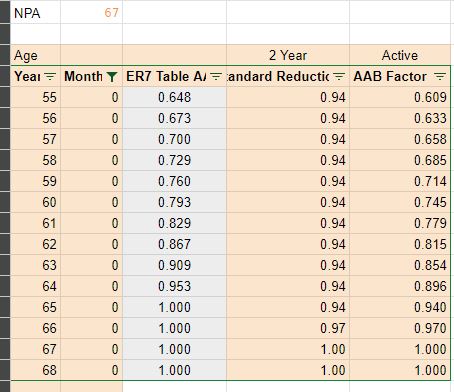

Warning of abatement on approaching NPA

In the years leading up to a teachers normal pension age, 60 for those in the scheme prior to 2007 and 65 for those who joined between 2007 and 2015, that taking the pension on, or after, reaching the pension age invokes the rules on abatement if they continue in TPS-eligible employment

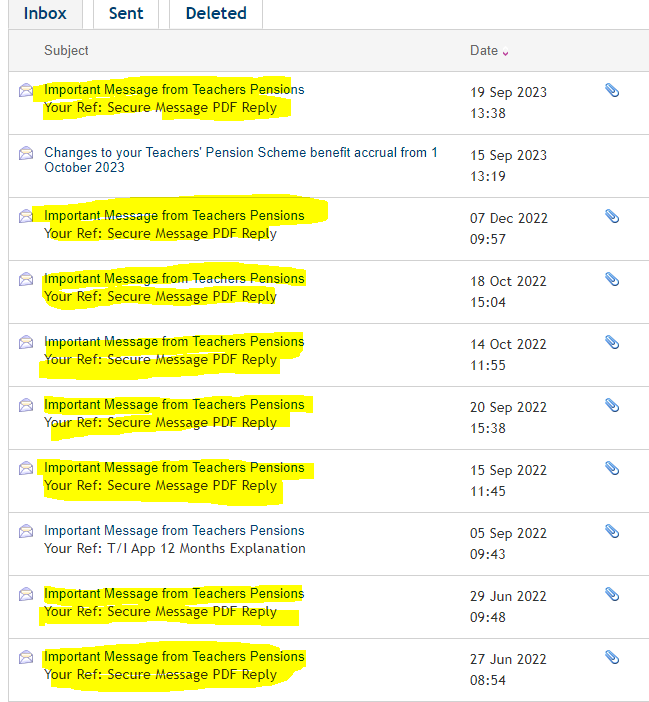

Threaded Communications

The structure of the message service on the website is geared to a single message and single response model. Great if the person responding answers the question being asked completely but confusing if follow up questions are required or they miss the point of the question.

Allowing messages to be threaded would remove the need to constantly repeat a whole message and clarify why the response sent was inadequate or misdirected.

The option to set a “subject” for the message would allow the sender to be able to find a specific message, at the moment they almost all have the same generic subject and reference:

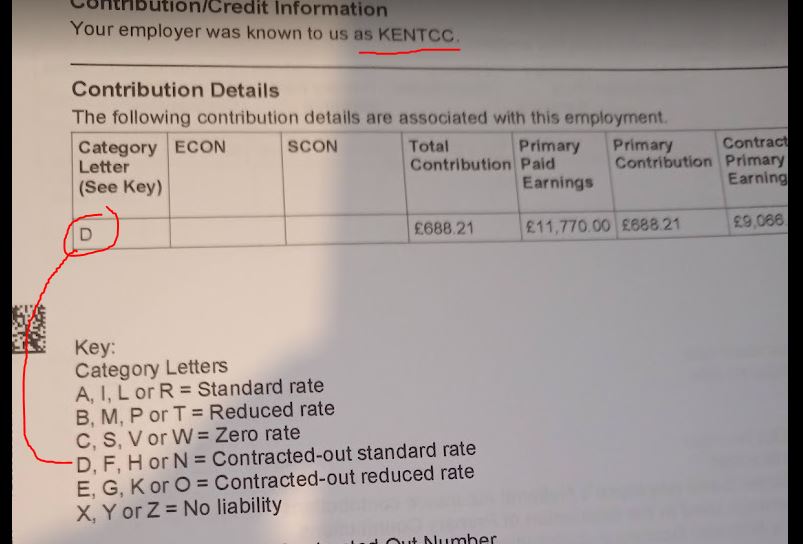

Part Time Data

Where part time teachers have concurrent contracts the part time earnings column can often contain just a 1.00. This makes it nigh on impossible for teachers to work out if the payment, and therefore the pension entitlement, matches what they have been paid for during that period.

CETV Calculator

Held up for many months (even years) due to waiting for “something” it shouldn’t be necessary for a manual calculation of this to be asked for.

Reset or Locked Out

Members report that they cannot simply use the password “reset” function at times and when they finally get through to a support agent it is because the account has been “locked” and requires the agent themselves to reset it. A message to this effect would reduce frustration and speed up the reset process. (Having a “code” to quote to the agent could lead the agent directly to whatever support document is required to action the process)

Data Validation

Teachers are reporting that during the application process the “data cleanse” operation undertaken by the TPS administrators often throws up anomalies in the service history, often going back decades.

In my opinion many of these problems could have been identified earlier and questioned at the time when records are still intact. With the advent of GDPR many employers no longer keep records going back more than 7 years, identifying and correcting errors at the time is much more likely to lead to the correct data being used.

Classis errors that we see time and time again for which an automated process to identify them sooner should be possible include:

- Annual Salary amounts jumping up and down, often because:

- Part time salaries have been used

- Updates to backdated pay awards have missed intervening months

- Someone has “fudged” the figure in their payroll to account for previous under or over payments (or to accommodate the splitting of April to align with the financial year)

- Breaks created where none exist, often because:

- The 5 day period in April has been created to line up their records with the financial year and no entry has been submitted

- School HR is unaware of the T&Cs of teacher contracts that require employment from set dates and not from when the employee first enters the building

- Double entries for the same period, often where a school instead of submitting an update sends in a second record thinking it will overwrite the previous entry