So you found a dodgy break in your history?

Over 90% of problems with the pension can be traced back to incorrect records being sent in to the administrators by employers.

The responsibility for putting errors right lies with the employer, the administrators (TPS) of the scheme have very limited powers to alter the records they have been sent, mainly only in cases where the employer no longer exists.

How to correct the problem?

Contact your employer and explain the problem and ask them to correct it.

They may be willing to do that immediately but with many employers no longer keeping records for more than 7 years you may find that they want YOU to prove that they employed you and that you were in the pension scheme.

Evidence?

PAYSLIPS: The very best evidence is your pay slips that show that the school employed you AND that you were paying into the pension scheme. The problems if often that we no longer have our pay slips and it can be many years, decades even, in the past that the problem exists.

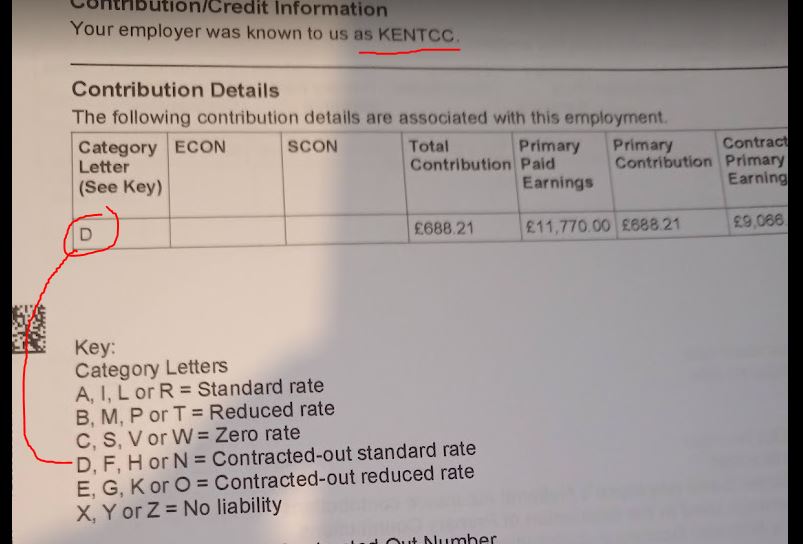

NATIONAL INSURANCE RECORDS (Pre-2016): HMRC keep records going back to the day you were issued with a number! As such you can ask them for this data and it is, for employment before 2016, very useful proof.

Before 2016 teachers who were paying into the TPS paid a special rate of National Insurance and so this is recorded by HMRC. It is called the “contracted out” rate. Ask TPS for your records of employment and the NI rate and it will show you, for periods up to 2016, both who employed you and whether you were in the TPS or not.

Look for the employer and the “Category Letter” for the employment as proof you were in the TPS

Getting your records

Make a “Subject Access Request”: https://www.gov.uk/guidance/hmrc-subject-access-request

Ask HMRC for the following:

- Name of employer and dates of employment

- Were they “contracted out” of the additional state pension

- The name of the pension scheme the employer reported as justification for being contracted out

- The ECON and SCON identifiers for that pension scheme

Getting Action

If you are in a Union see if they can get you legal help to draft a proper letter advising the employers of their legal responsibilities and potential liabilities if they fail to address this issue in a timely fashion. If you are not in a Union then check to see if you have legal protection included on your home insurance.

You also have the option to refer the matter to the Pensions Ombudsman for “maladministration”.

The kind of thing that we have heard can get results is to “remind” the employer of the potential costs to them if they do not get it sorted, nagging them repeatedly and making it “easier” for them to resolve the situation – keep squeaking.

Run this by a lawyer but something along the lines of…”The records of my employment history for the purposes of calculating my pension as held by the Teachers Pension Scheme administrators (TPS) for my time in your employment from dd/mm/yyyy to dd/mm/yyyy are wrong. I am informed by the TPS that only you as the employer may make corrective updates via the monthly data collection that they require you submit to them. I have also been advised that should <name of employer> fail to make the necessary corrections in a timely manner and that as a result I were to suffer any unavoidable financial losses then <name of employer> may become liable to cover such losses. The Pensions Ombudsman may in addition, upon finding a case of maladministration, direct the employer to make financial compensation for distress and inconvenience. The scale of such compensation rising when the employer has not demonstrated that they have taken action to address the complaint. As I have not heard from you since I last communicated on this matter since dd/mm/yyyy then I must start to consider taking such actions.

My preference is, of course, to have the records held by the TPS in respect of my employment with <name of employer> updated to correctly reflect my service with <name of employer>. Specifically ((((now insert what you want the data to show)))).To avoid increasing the anxiety this matter is causing me and to alleviate the distress please can you communicate to me within 15 working days what steps you have taken to provide the TPS with the necessary corrective update to the employment records held by them on your behalf.”

Hello David

I have found your site and YouTube videos extremely helpful as I have had a problem correcting my Employment History. I do not have salary slips for 5 missing months on my record which is described as a break in service and my school (I have been in the same school throughout my teaching career) have no access to payroll information from that time.

I submitted a SIR to HMRC who sent me my NI record for the period in question which was April 1993 until August 1993. This did not include the D code that you explained was vital to indicate that I was contracted out. I telephoned HMRC who sent the information which shows I was in fact contracted out at that time.

I have shown the information to the school finance office who telephoned Teachers’ Pensions in my presence, only to be told that they needed to see payslips.

I have since checked on the TP FAQs which states: “Should you no longer have the relevant payslips you’ll need to contact the National Insurance office for an NIRS2…..Please note that a SARS print isn’t sufficient evidence of contributions to our Scheme. This only provides evidence of National Insurance contributions and aren’t relevant to your teacher’s pension. Although this will show your employer for the time in question, it’s not proof of contributions into our Scheme, though it may be used to show that you were paying the lower rate of National Insurance, D-rate, as you were contracted out of the State Earnings Related Pension Scheme (SERPS). ”

I really feel I have hit a brick wall. Why on earth would I have D-Rate contributions whilst employed in a school unless I was paying in to TP? I wonder if you have met this situation before and have been able to offer any advice on how to proceed.

Many thanks in anticipation of any advice you can offer.

Patricia Shinks

Ask HMRC for the following:

1) The name of the employer.

2) Confirmation that you were “contracted out”

3) The name of the pension scheme the employer reported that you were a member of that allowed them to contract you out.

Many thanks David for the speedy reply.

I think the two replies I have had from HMRC together contain that information.

Is there any way I can forward the two letters to you as scanned attachments just so yo can check that I am not missing anything?

Thank you,

Pat