Turn back time and buy AP in the Final Salary Scheme

- Link to my Spreadsheet (NPA60 Final Salary)

- Link to my Spreadsheet (NPA65 Final Salary)

- Link to my YouTube Video on RAP

- Link to the TPS Application Form

- Link to my YouTube video comparing current flexibilities to RAP

- Link to my Spreadsheet – Potential implications to the Annual Allowance

Up until this point we have been told to complete the old form and include a covering letter requesting the application be taken for additional pension (AP) to be purchased in the final salary scheme during the remedy period.

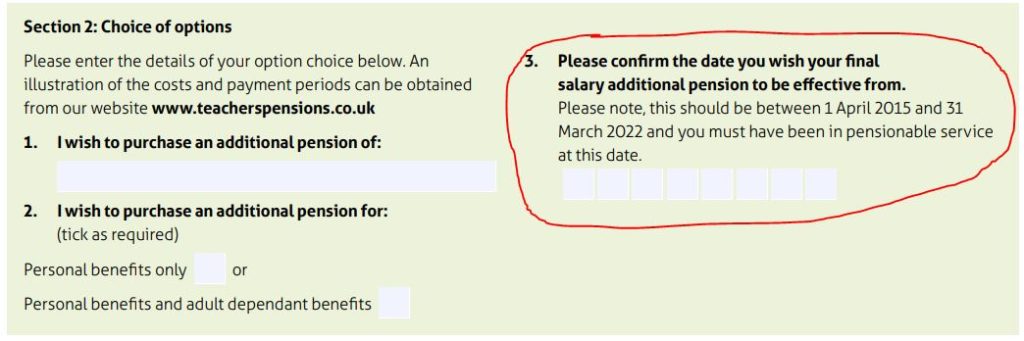

Before I start going into the details of this there are some parts which are not completely clear and so I must warn you that the figures may not give a true and accurate picture. However, the figures I do have are from an application made for retrospective AP. This date is asked for on the new application form in Section 2

I am going to assume that the “Pension Increase” will be applied from the date that the additional pension (AP), however this is not certain to be the case as the letter I have seen says this: “Your Additional Pension increases in value from the date of your full payment to your retirement date in line with pension increase factors.“

I am basing my assumption though on the fact that the payment requested does include an element of interest based on the time that has passed since the date asked for in Section 2 above. I don’t believe you can charge interest on something if you then take the date of the payment as the basis for applying the value of what has been bought.

Figures for 2016 – 50 Year Old

AP has to be bought in blocks of £250 but for the purposes of this post I will look at purchasing 4 such blocks, totalling £1,000. The date for this to be taken as 2016. I will also include the purchase of family benefits (50% to a partner etc)

£1,000 of FS AP (2016) would cost £16,080. Interest charged £1,382.

My Analysis

The interest for nearly 8 years is only 8.59%, that’s a simple annual interest rate of somewhere between 1.0% and 1.3%. That “feels” like good value.

Pension Increase: from 2016 to 2024 the inflation rate is in the region of 31.87%. If this is applied to the £1,000 then it would be worth £1,318.70 now.

Age to recover the investment

If the Pension Increase is applied from the elected date of purchase, which I believe it should, then dividing the cost (£17,462) by the current value (£1,318) gives us 13.3 years.

Taken at 60 that would be by 73.3.

If I am wrong about the way the PI is going to be added then it wold take 17.5 years to recover the investment, so by the age of 77.5

Compared to buying AP in the CA scheme now

The question here then, is it better to buy retrospective FS AP or to buy AP in the current career average (CA) scheme. For this comparison bear in mind that a 50 year-old in 2016 would now by 57/58.

A 57 year-old buying £1,000 of CA AP (2024) with family benefits would pay £15,160. That would take them 15.2 years to recover that investment. However, this AP would only be paid, in full, if they started taking it at 67.

67 plus 15.2 means they would get their investment back at the age of 82.2

I would suggest, therefore, that if you are considering the purchase of additional pension then it would be far better value to make an application for the retrospective purchase of AP from the remedy period than to buy it in the current career average scheme.

Hi David, once again great work and pretty crazy that there isn’t more clarity on this from TP. Do you have any idea how to get a definite answer to the question of when interest is added to the extra pension purchased? That decision going the way it logically should, would you suggest opting for the earliest date, April 2015, as the best choice for extra pension, or is there more to it than that? My birthday is mid march and i’m in my 40s… presumably buying this asap is the best way as with most things pension?

The key eligibility for this is that you have to be able to demonstrate that you would have bought it at that time. Putting 1 April 2015 would have me, if I was running this, asking you why didn’t you do it on 31 March 2015 when you were still able to do s

Hi David

IS the 31st March 2024 the last chance to apply for this, as is the case with the other Flexibilities?

Thanks

No, you have up to 6 months from the date you are sent your REMEDIABLE service statement – not the current ROLLBACK statement

Hi David, thanks for all the info you share with us all, I’m very grateful 🙏.

Am I correct in thinking that you only get an RSS when you apply for your pension? If so, does this mean that as I won’t be taking my pension for a few years yet, the Retrospective Additional Pension in the Final Salary scheme is not an option for me?

Thanks, Emma

At the moment almost all of those who have received their RSS are those who are applying for retirement, BUT, the legislation states that EVERYONE must be sent their RSS by April 2025.

Even without an RSS the TPS are accepting applications for retrospective AP purchases.

Thanks David. One more question then, how do I find out how much it will cost me to buy the additional £250 blocks? If I’ve understood correctly this is age dependent and the age in your example doesn’t work for me.

Thanks, Emma

Yes, tricky. They have removed the calculator for the FS option from the website. They won’t tell you until you apply!

Roughly though you can use the current calculator on their website, for the CA pension, and multiply the cost it give you by 1.43

Hi David,

I have the form from your link- thank you. I cannot find the spreadsheet that you mention in your video on Retrospective additional pension?

https://docs.google.com/spreadsheets/d/1n_yclIFleF5Ioe3N4tFVlhDoHiOjW_Ib_3Jz60Q9cuY/edit?usp=sharing

Thanks for this – it’s very useful. I’m trying to decide if I should do buy retrospective Additional Pension Purchase or not. I’ve been in TPS since 2007 and I’m currently 51. Always worked PT but planning to go full time for the next few years. If I purchase (retrospective) Additional Pension in the Final Salary Scheme will I still be able to choose Career Average for the rest of the pension if it works out better?

Or should I get an AVC with a private provider? Would that have advantages?

Any pointers would be much appreciated.

This is something that steps outside my expertise, I cannot give you advice as to what would be the “best” investment.

Yes, buying retrospective AP does not prevent you from going with the CA option when you retire should that be your preference.

Hello David, do you have any update information on how long TPS are taking to process AP applications. I sent mine to them a couple of months ago and not received a response yet? I suspect they are swamped with all the RSS queries.

No definitive timescale. I have had some tell me that they have paid the invoices that were sent out but no real details on how long they had to wait etc.

Thanks David, very helpful!

Thank you for your helpful advice. I’ve just submitted a form to the TPS to see how much it would cost me for £1000 worth of pension backdated to April 2015. Do you know if it’s possible to do this more than once ? (eg could I then buy more later or would it all have to be done at once). Also thank you for your helpful video about getting the tax back.

You can apply for those periods where you WOULD have bought it had you not been discriminated against and prevented from doing so. That means you should be able to start the purchase of it many times in that period. The form does suggest you have to pay with a lump sum, but following complaints that have been escalated to the DFE the TPS have agreed that you can ask for a monthly plan to make the purchase. To do that you would have to include a letter making that request and laying out the number of years you want to make the payments over.

Thanks for all this David. Do you have a link to the DFE escalation. I would like to link and quote in my letter.

Sorry but my Long Covid brain is struggling despite reading all these posts. How do I know the date I was moved into the CA scheme please? I have Transitional Protection according to my benefit statement. Can I pay in a one off lump sum and of so what is the maximum please? Thank you. NPA 65 currently 57 looking at early retirement or IHR very soon.

It is on the second page of this document: https://www.teacherspensions.co.uk/employers/advising-members/eligibility/~/media/93CC7173567A46B2A3D99E4D242FCEE9.ashx

I bought additional pension commencing Dec 22, just outside remedy period. Would I be able to apply for retrospective additional pension?

So long as you have Transitional Protection and were moved into the CA scheme before April 2022 then, yes, you can.

One final question, what difference does the date in section 2 make?

It is the date that you believe you WOULD have started buying Additional Pension if you had still been in the Final Salary scheme at that time.

Indexation should be applied from that date and the costs will be based on your age at that time.

Sorry to be a numpty about this. Is there a really simple explanation eg what is Retrospective Additional Pension Purchase and who can apply please?

Additional Pension – you hand over a large sum of money now and they promise to pay you regular sums in the future.

The amount they promise to pay you will increase by inflation each year.

The “large sum” depends on how much you want to buy and how old you are.

The “retrospective” part means you get to apply as though you were a lot younger – as far back as 2015, so up to 9 years younger.

Your are allowed to do this if you have “transitional protection” and would have bought it at the time if you had not been, illegally, moved into the Career Average scheme at that time.

Just looking at doing this with some PILON I will be getting at the end of August.

I am 53, and my best years for Method B are 2017 to 2020 as I had a promotion in 2017, so a strong argument to say I would have purchased during this period. Does the year you chose affect the cost of AP?

Yes, the more recent the year the “older” you would have been and so that makes them more expensive. Also, there was a hike in the costs in 2019 (and again in 2024), so doing it before those years is cheaper…and if you are going to ask for a monthly plan over a number of years if that takes you into those years it gets more expensive.

https://docs.google.com/spreadsheets/d/1n_yclIFleF5Ioe3N4tFVlhDoHiOjW_Ib_3Jz60Q9cuY/edit?usp=sharing

Thank you for drawing attention to this – having worked part-time for much of my teaching career, I am considering boosting my (relatively small) pension by buying some retrospective AP, but wanted to ask about the assumed increase in value (in line with pay increases) of AP bought retrospectively. Do we have any ‘official’ confirmation that this is the case? i.e. will a £250 block of ‘2015 pension’ definitely equate to approx £330 of ‘2024 pension’? It makes a significant difference to the value of doing this. Many thanks for your help!

Yes, the letter I have tells me that the amount I applied to purchase from 2016 would be increased by inflation from that date, and shows me the current value which matches the inflationary increases.

Just what I wanted to hear! Many thanks 👍

Hi David, if you do retrospectively buy additional pension in the CA scheme, can you take it early – retiring at 57 for example and having it actuarily reduced?

Also, could you buy £1000 of additional pension in each year 2015-2022 – I know it’s expensive but probably good value?

Thanks

You have to make a single application but I see no reason why you could not ask to do that. However, it would probably be better to ask to buy £6,000 but with a payment plan to pay for it over 7 years.

It would be in the final salary scheme and so have an normal age of 60 or 65 depending which scheme you were in. Taking it before the normal age would see it be reduced, but of course it is paid for more years.

Hi David

You have really increased my awareness of the Teacher’s Pension. Thank you so much for all your insight!

The TP website says I have transistional protection. I asked them if I could buy retrospective pension via the secure message, however they are experts at not giving a definitive answer!!! Any words of wisdom from you are much appreciated.

Do I need to have received my remedial service statement inorder to apply for retrospective pension. Indeed, when will I know if I received this and how? I am panicking incase I have received it but just don’t know it! I understand that the deadline for everyone to receive this is April 2025 and that the deadline for applications for retrospective pension must be within 6 months of receiving it.

Is there a limit on the amount of retrospective pension I can apply for in a given year? I was 47 in April 2015 and I would ideally like to purchase 8 blocks of 250. Am I able to do this in one year (i.e. 2015) or do I do this across 4 years- 2015/16/17/18. If applying across 4 financial years retrospectively if the option, then do I need to apply via the paperform four times?

And, finally, the TP says that I need to add a covering letter with the paperform stating that, ‘we ask that when sending in your

form you add a covering note confirming that you wish your application to be treated

retrospectively, and from what date.’ Do I need to give any further explanations as to why I would have purchased at that time, if I was able to.

Thank you so much for taking the time to read this 🙂

They are a little reluctant to give direct answers to much of this and I think they are understaffed and struggling to meet the April deadline for the issuing everyone involved their RSS. As such applications appear to have been kicked down the road where possible.

No you do not need to wait for the RSS but your 6 month time limit to apply doesn’t start until it is issued. The RSS will appear in your “messages”, but unless you have applied for your pension it is very unlikely you have received one yet.

There is a total limit on how much AP you can buy. Around £6000 back in 2015 that would now be worth around £8000.

I have heard that they are limiting applications to a “single” application, which makes sense to me since the point of applying now is that you WOULD have bought it back at the time and as such is not something you would do a bit now and bit later etc. However, I believe they would have to accept an application that asked to purchase blocks in different year as this could reflect the approach a teacher may have taken at the time – and this is all about giving teachers the opportunity to do what they were illegally denied the chance to do back then. The form doesn’t accommodate this and so a covering letter and/or scribbling over the form may be required. Alternatively, yes, you could ask to purchase the full number of blocks you would have bought in total (8 as you say) and ASK to have a monthly payment plan over 4 years. Indeed, spreading the cost over a number of years would seem sensible for a large purchase as it maximises the tax-relief that can be applied.

Thank you so much for your advice!

Hi David

I have another question with regard to retrospective pension that I am hoping you can answer 🙂

Am I right in assuming that I can only purchase additional blocks in a given year up to ‘purchase limits’ for a financial year, so around 6.5k. So, for example if I wanted to buy 2k additional annual pension, I would need to buy this across 4 financial years so that it didn’t exceed the amount I can purchase in one given year? I was a 40% tax payer in 2015 and 2016 and then a 20% tax payer after that. It would be cheaper for me to apply across those first two years, however can I?

I contacted the TP via secure email about buying additional retrospective pension and they answered saying that there would be an additional interest applied, stating. ‘any final salary additional pension lump sum payment is subject to interest at the National

Savings & Investment (NS&I) rate from the date of the election to the current date’. I don’t really understand what this means in terms of purchasing the blocks, although it looks like your calculator takes this into account?

Thank you again for your words of wisdom and for unravelling the knitted fog around this!

The limit is cumulative rather than “per year”. Once you have reached the limit (£6,250 back in 2015 but over £8,000 in 2024 – if you had £6,250 in 2015 inflation would mean you are over the 2024 limit already so it doesn’t allow you to buy more).

The other limit relates to the amount of income tax relief you will get. If you ask to purchase so much that it exceeds you taxable income for that year, or the annual limit of £40k/£60k etc, then you won’t get relief on all of your payment.

You can ASK for a payment plan over any number of years so long as it would have finished being paid for by your 60th birthday. Depending on how much of your salary was at 40% this might mean going over two years might be the best option.

If you are asking to buy AP in 2015 and the cost is £20k then they will add on interest to the amount you owe, so £20k minus the tax relief might by £17k (some 40% some 20% tax relief) and then interest is worked out on 9 years of £17k being “owed” to them. The interest rate I have had a rough stab at including on the sheet but it is not 100% accurate.

Hi David,

I just want to start by saying a huge thank you for the unpaid, generous use of your time and probably money in helping people out.

I have just rung TPS about retrospective additional pension. I am about to retire at some point in the next year or 2 and have transitional protection. I asked about the additional pension and was told it closed at the end of March!

If that “advice” was incorrect and I can apply, does the extra pension attract an automatic lump sum due to being in the final salary part of my pension?

Thank you,

Tony.

It is incorrect, please submit a complaint so that the call handler can receive corrective training and not pass on this duff information to others.

You have have 6 months from getting your RSS to apply for Retrospective Additional Pension, though you must do so before sending back your option choices for retirement.

Additional pension does not add anything to the automatic lump sum.

Thank you.

Hi David,

Sorry to ask another question. I am not quite getting my head around the following point:

Additional lump sum. I thought I could convert 25% (so 1/4) and then multiply by 12…so in theory I can have x3 my pension part given up as an additional lump sum. However, I have read that the max additional lump sum is x 33 then / 14….which is clearly not x3!

Example:

Pension annual amount =£24000 (£20000 FS + £4000 from CA)

Automatic lump sum = 3 x £20000 = £60000 (only given from FS)

Additional lump sum (give up 25% = £6000) £6000 x 12 = £72000

However Max Additional Lump Sum is £24000 x 33/14 = £56571.

Am I doing something wrong here?

Sorry to ask.

Thank you,

Tony.

Hi David, your fantastic work is very much appreciated. It is crazy that TP do not have all of this information clearly laid out on their website. So thank-you very much.

My request here, thanks.

Do you have the link to the case whereby they have relented on monthly payments? I also wonder what would happen were the payments not quite made over a four year elected period… would they allow it to be extended or would the whole thing cancel? I suspect you will not have the answer to that – nor them! – but it is a point worth raising. I guess they may well calculate down the quantity purchased if payments were to cease entirely.

Is there any indication of the length of time over which payments might be paid? Ten years might be reasonable, as would have been requested at the time? Is it substantially cheaper to do it in a smaller time period? Any major dangers here?

Many thanks again.

As of yet, they have accepted that applications can “ask” for a monthly payment plan but I have seen no cases where they have given the costs for such a plan.

The option for a monthly plan was based on the right to have asked for one at the time, but such a plan was to be made over a full number of years. So if you asked for a 4 year plan and you had only been employed for 3.8 years from the date you asked then I imagine that might be an issue. Strictly speaking they should let you start the plan and then, 3.8 years into it, give you the option to take the proportion you would have paid by then or make a final lump sum payment to cover the remaining monthly payments.

The length of time allowed should match what would have been available to you from the time you would have purchased. That is a length of time that would not take you beyond 60 (or 65 if you were in the NPA65 60ths scheme).

For example, if you asked to start buying AP on 1 April 2016 and would have been 50 at that time then you are going to be limited to asking for a 9 year plan.

From the calculators on the website, still available for the career average scheme but from my memories of the previous ones, purchasing it with a lump sum was the cheapest option.

However, the annual payment plan was really only more expensive because it factored in inflationary increases and so paying £200 a month in the first year was more painful than paying £200 a month 5 years later when pay had gone up.

It is worth noting though that there were increases in the costs of AP, which are passed on via higher monthly charges, in 2019 and 2024. If you ask for a 10 year plan starting in 2016 then you would have 3 years at the cheapest rate (2016-2019), 5 years at a higher rate (2019-2024) and 2 years at the current highest rate.

As per everyone one else, a heartfelt ‘thank you’ David. My question is, for someone still working and over 60 (who wasn’t aware that if untaken one’s pension doesn’t increase/abatement), and who is further disadvantaged by not being allowed to buy AVCs (because one’s over 60); can one buy retrospective AVCs, and if so, what’s the max (other than annual allowance); can something be put in for every year (so over 20k total?). Thanks!

Hi David,

I’m just oof the phone from Teachers Pensions for the 2nd time today (and many times before). My question is: I’ve never purchased Additional Pension Benefits, therefore I want to buy the maximum amount possible. I’ve had various amounts of what that maximum is: £6250, £6300, £6500 and £8,500 – all from different advisers! As it’s the maximum amount and I want the effective date to be from 1/4/2015, I’m assuming that I have to use the 2015-2015 figures. However, on the TP forms/updates section it states:

For the 2017-2018 scheme year the maximum amounts were:

Career average scheme: £6,600

Final salary scheme: £6,400

For the 2015-2016 and 2016-2017 scheme years the maximum amounts were:

Career average scheme: £6,500.

So the final salary scheme isn’t mentioned?! Do I just assume it’s the same? There’s also the effective date question (question 3 on section 2 of form APB APP). I find that confusing. If I want to get maximum benefit from my application, is it best to go for the earliest date? I have been in employment from before 1/4/2015 so I could put that.

Any information and guidance would be appreciated as TP aren’t giving me best clarity.

The limits increase each year with inflation but once you’ve hit the limit you can add no more. The amount you purchased is also increased in value. In essence, £6,250 in 2015 is the same as £8,500 in 2025.

As AP can only be bought in blocks of £250 the £6,400 limit isn’t going to allow you to buy more than £6,250.

2015/16 it was £6,250 for the FS scheme.

Thanks for your reply David – I’ve added an update below.

Do we know the approximate timescale for applications to buy Retrospective Additional Pension? I posted off my form over 6 months ago, and have had no acknowledgment or reply from TP. I messaged them a few weeks ago, through the TP website, asking about this, but (as usual) have not had a response.

No, there is no set timescale. Your message though is recorded now on their system and so they should allow you to make an application after the deadline has passed if they have “lost” your application.

If you want to be sure they have it then give them a call and see what they say…then follow that up with a message to put in place more evidence that your application has been received.

Hi Dave,

Thanks for the talk on Wednesday. It was really useful to hear from someone who is looking at all of this from the perspective of having been through it.

I’m hoping to retire at 55 or 57 but wondering if it’s worth trying to add some Retrospective contributions from now, at age 53.

I’d like to add a extra £2,000 – £3,000 to my annual pension and trying to work out if adding to my TP makes more financial sense than adding to an ISA or a small private pension.

Do you have any thoughts on it. Not advice, but any experience or knowledge?

Best wishes,

Alison

Buying a pension means handing over a “large” amount of money for the promise to pay you “small” amounts in the future.

If you live long enough then that might be considered a good bargain, but if you were to die early then less so – of course.

My thoughts are here: https://youtu.be/W6RqR9UgzPQ

Hi all,

At long last, last week, I received a reply from TP on how much it would cost me to purchase the maximum amount of retrospective Additional Pension – £6250 I want to apply for. This has, to date, taken me 5 months, involving countless messages, phone calls and two official complaints!

During the latest phone call, I was told that there was an email with the letter waiting to be sent, that hadn’t been actioned! I’m constantly flabbergasted by the ineptitide of the TP team!

I made the customer representative stay on the line whilst I confirmed I wished to have an invoice for the application. I also confirmed this in writing.

The fantastic news for me is that it is going to cost me £69k to ‘purchase’ around £8600 of AP. On the current calculator, it comes out as £133k!

So, in theory, it’s a huge result and a complete no-brainer if I’m lucky enough to have the funds to finance this.

I have three questions though, if David or anyone else is around to answer them:

1. How will this £8,600 look on my pension? Does it just permanently sit at £8,600 or does it continue to accrue value/interest?

2. Will it appear on both my final salary/career average and career average estimate on my RSS?

3. As I’m a HT, I pay part of my income at the 40% rate. Whilst the statement shows some tax relief, can I also write to my tax office and ask for a further rebate? I’m told that you can, as a one-off, ask for a three year allowance of pension contributions and get a rebate on that basis. As that’s currently £60k PA, I’d easily be within the £180k combined, taking in the £69k plus the year’s contributions.

I’d be happy to ‘repay’ anyone with advice on how I went about applying for my retrospective AP.

Hi,

I’m glad to hear this is working out for you – I think I’m in a similar boat and hoping that I can claim the HR tax back with the allowance spread over 3 years Did you make any progress with the rebate? Thanks for sharing your experience!

It feels like I’m a little late to the party on this but thank you David for this extremely useful info and for taking the time to help out your fellow teachers!

Hopefully I’m not too late to purchase RAP as I still haven’t received my RSS. I’m in a bit of a tricky position though, as I’m about to come out of the TPS to a DC scheme in an independent school. I was a bit nervous that I might miss the option to purchase RAP as a result. The TPS site seems to suggest it is available to deferred members, but when I contact TPS, they tell me that flexibilities are only for active members. They then say they’ll have to pass the query on and get back to me, but I don’t really have the time to wait – does anyone here have experience of applying for RAP as a deferred member?

RAP is not a flexibility, which is the term for the current offerings in the career average scheme.

RAP is for the old final salary scheme, and can be purchased as a deferred member – I have done it!

The primary concern I have is the 6 month deadline, though some have reported that they were told that the 6 months doesn’t start until they get their RSS after applying for the pension – I seriously doubt that is the case having read the regulations.

A very belated thank you for this reply! I’m afraid that my planning for pensions and such comes ‘in waves, when I have a spare moment!’ so I’ve only just checked in again with this. I had a message on my secure messages to say that I can apply for RAP even though I still don’t have my RSS. I’ve submitted a request so…fingers crossed!

Massive thanks David for helping me understand all of this and in particular, for providing the spreadsheets. It took over 6 months from start to finish to go through the process but this was extended by my realisation, after completing the purchase, that the TPS had used the wrong factors (they had used factors for NPA60 and should have used NPA65) to calculate the cost so they had charged too much. I only realised their mistake because TPS’s cost calculation was so much higher that the estimate from David’s spreadsheet that I thought I should double-check their numbers. A bit scary that TPS could get this wrong – I would never have realised without your help.

Oops! Yes, glad to hear they helped you get it sorted.