I threw away £8,000 and to make it worse, continue to throw another £2,000 away every year. Learn how to use a little known rule to protect your pension.

https://www.youtube.com/watch?v=sFGJbmtMQHQ

Worked Examples

Restricted Example

Service to break 6 years, service after break 7 years.

Salary at break: £40,000.

Salary at end: £32,000.

End is LOWER than Break = Restricted

1) Break calculation: 6 years / 80 x £40,000 = £3,000 (then inflation is added, say 7 years @2%=~15%) £3,000 + 15% = £3,450.

2) End calculation: 13 years / 80 x £32,000 = £5,200

The best of these is £5,200, so that is what is received.

Unrestricted Example

Service to break 6 years, service after break 7 years.

Salary at break: £40,000.

Salary at end: £44,000.

End is HIGHER than Break = Unrestricted

1) Break calculation: 13 years / 80 x £40,000 = £6,500 (then inflation is added, say 7 years @2%=~15%) £6,500 + 15% = £7,475.

2) End calculation: 13 years / 80 x £44,000 = £7,150

The best of these is £7,475, so that is what is received.

Teachers Pensions Refusing Hypothetical Calculations

The hypothetical calculation is made every time you have a break in service and with teacher’s pay failing to keep pace with inflation for more than 10 years – and likely not to do so for quite a few more, it can easily mean that you will get a HIGHER pension than the one shown on your benefit statement. The problem is that TPS routinely REFUSE to tell you how much this calculation would give you.

One teacher I’ve been chatting with recently finally managed to get a successful conclusion by submitting a formal complaint. This is a paraphrased account of what happened:

Teacher to TPS: Please could you confirm what my pension will be based on the break in service I had in 2010

TPS to Teacher: Thank you for your secure message. I should explain that we do not provide hypothetical estimates of benefits. These calculations are only performed at retirement when a completed application for benefits has been received. I am sorry for any inconvenience this causes.

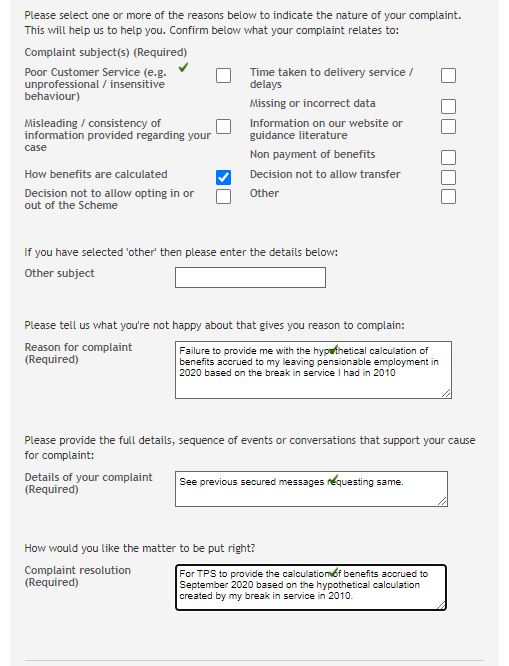

Teacher to TPS: Via complaint form

- Nature: “How benefits are calculated”

- Reason for complaint: “Failure to provide me with the hypothetical calculation of benefits accrued to my leaving pensionable employment in 2020 based on the break in service I had in 2010”

- Details of complaint: “See previous secured messages requesting same.”

- How to put right: “For TPS to provide the calculation of benefits accrued to September 2020 based on the hypothetical calculation created by my break in service in 2010.”

TPS to Teacher: Within the week a statement detailing the hypothetical calculation was provided for the teacher. The amount from this calculation was in the region of 10% higher than that he had been given previously

David

Thank you for your excellent and helpful content.

I would be grateful for your thoughts on my situation.

I am 49 and have 24 years’ service. I intend to retire in 8 years’ time.

My current statement uses Method B (from years 7, 8, 9 & 10) to arrive at an average salary of £59210.

My current salary is £54203 and, aside from rises linked to State Sector, is likely to remain the same for the duration of my career.

It seems to me that it would be beneficial for me to take a 1 month break in service to lock in the £59210 calculation. Do you agree?

Also, am I correct in saying that any future pay awards would need to outstrip inflation (or however salaries are revalued) by about 9% (59210/54203) for my average salary at retirement to be greater than my average salary (£59210) at the break?

If so, this seems unlikely and thus mine would be the Restricted Hypothetical Case and my pension would be based on the £59210.

Any thoughts you have would be greatly appreciated.

Thank you

Sounds like you have it correct, but one thing. With a break now you do not have to be concerned about whether you get the restricted or unrestricted version.

You can no longer add any more “years” to the final salary scheme, that ended on 31 March 2022, and so the restricted calculation adds no subsequent years, but neither can the unrestricted version.

All subsequent years are counted in the career average scheme and you get those whether you had the restricted or unrestricted final salary calculation.