Both my wife and I were teachers and as we entered out 50s we knew we needed to start planning for our retirement rather than just letting it happen. This is our path along with a few other notes of things we wished we’d known earlier or could have taken steps when they would have made a difference – hopefully they will help you plan your own journey.

Steps whilst working

- Our plan

- Opt out for a better pension?…Counter-intuitive it may be but don’t discount the option…

- Check the pensions (Teachers and State)

- How much do you need?

- Taking ‘Early’ retirement

- Future work

Stepping away

Stepping forward

…

Useful other links

Notes

Steps Whilst Working

Our Plan – our path amongst many

This is a recollection of our thoughts and process. It is our path, it is not the only path.

In our late 40s we started to consider what what we would need in order to stop teaching. The end of the mortgage gave us a little more disposable income, new pension flexibilities allowed more direct access to private pension funds and personal circumstance meant we needed to consider how we could afford, at least one of us, to stop working.

Tracking Spending

The first step was to take a stock check of what we were spending our money on. To make this easy we used just one bank card on the shared account for everything. At the end of each month we’d download the transactions and put them in a spreadsheet. This allowed us to see what we had to spend; water, electricity, food – the necessities, and what we chose to spend; takeaways, sport, holidays – the luxuries. This allowed us to work out what we a) needed and b) wanted.

Budget

We knew that the pension would be a lot less than our salaries so we set ourselves the target of living off just one salary, putting one salary aside into a different account – out of sight, out of mind.

We also set about cutting costs; shopping around when the big annual insurance and energy bills needed renewing is something you often hear about, and yes, that did save a few hundred pounds in the first year – and if you consider the ‘hourly-rate’ for those 5-10 minutes work it’s astounding! However, another valuable lesson was to see just how much could be squeezed from the weekly grocery shopping. This was quite easy as I had become a bit of a food snob, always buying the big brand items. A few blind taste sessions soon put me straight on that one! (though for a few items the branded versions remained on the list). When a tin of beans saves you 25p, a bottle of ketchup over £1 it soon adds up.

If you can save just £6 a week from the weekly shop and you’ve saved over £300 a year…even better than the saving on the car insurance.

Future Fortune

Knowing how much we needed each year we could put a figure to different lifestyles. In 2017 we worked out that we could live, frugally but not painfully, on £12k. £18k would be comfortable and allow us to afford big-ticket items such as new car every 6-10 years. £24k would be very comfortable. The teacher’s pension’s therefore needed to be worth around £12k each and the index-linked element of these should mean that they would hold their value as the years ticked by. It also meant that we could work out how much ‘other’ money would be needed to cover any shortfall or indeed years where we could not access the pension.

If by taking the pension early the pension was to drop below £12k we considered how to delay taking it – putting money into a private pension that we could access after reaching 55 but before taking the teacher pension was an option we considered.

Opt out for a better pension?

- Bonkers isn’t it, can opting out really mean getting a better pension?

- Everyone’s employment history is different but there is a chance that opting out may result in you getting more. It mainly affects those who have any Final Salary benefits due to a little known rule about how the “Final Salary” is worked out. Check this slide show for more

- If you’ve not had a break in service in the last 10 years, been on the same pay scale for years, have taken a pay cut or gone part-time then you really should check out how the rules work.

- I’ve just done the calculations for a colleague who is planning to retire in 21 months time. They would pay about £10,000 in pension contributions to see their pension rise by £70…but they could, instead, buy additional pension of £250 for about £5,000 and opt out now…getting both a better pension and paying less for it.

Check the pensions

- Teachers Pensions – teacherspensions.co.uk (TPS)

Check your employment history, any gaps can only be fixed by your employer. The TPS cannot make changes even if you have all your records, payslips, testimonials – a note from your mum…getting these sorted before you finish work is far easier. Normally a quick note to the employer will do the trick but some have to get the union involved…and occasionally a formal letter to the organisation telling them that unless they correct their error you may hold them liable for any financial consequences that you may suffer.

- The State Pension – https://www.gov.uk/check-state-pension (Use only government based sites)

Changes were made to the state pension that mean that many of us retiring (written in 2019) may not qualify for a ‘full’ state pension. This site will tell you how many more years you need to complete in order to get the full state pension.

Voluntary National Insurance – if you need more ‘years’ to qualify you can pay voluntary NI. Strangely there are TWO different voluntary rates, “Class 2” and “Class 3”. In 2019 Class 2 cost £3 a week and Class 3 cost £15 a week – there are different eligibility criteria for these but interestingly if you work as an examiner or invigilator (jobs well suited to a retired teacher) then you can pay the cheaper class 2. See the sites below for more details:

- https://www.gov.uk/voluntary-national-insurance-contributions

- https://www.gov.uk/national-insurance/what-national-insurance-is-for (the difference between benefits for Class 2 and Class 3 contributions)

How much do you need?

- Clearly working out a budget will help you understand this but rather than sit down and plan it all out all I did was keep better records of what I was spending.

- Keep full records: To do this we used one card and account for everything, online bank statements could be downloaded and categorised…whilst at first I did this every month it wasn’t a problem to leave it for 4,5 or even 6 months at a time. Using the sort tool in a spreadsheet meant it was easy to put the same direct debits etc into a category very quickly. I would suggest you learn how to do pivot tables.

- When comparing your salary to your proposed pension don’t be scared by the drop…going from £45,000 to £20,000 may seem a lot but check the NET figures after all the deductions such as:

- Salary of £45,000

- Deduct £5,400 National Insurance @ 12%

- Deduct £4,590 Pension Contribution @ 10.2%

- Deduct £5,582 Income Tax @20% on taxable income

- NET Income: £29,428

- Pension of £20,000

- Deduct £1,500 Income Tax @20% on taxable income

- NET Income of £18,500

- National Insurance @ 12%…pensions don’t pay NI

- Pension Contributions @8-12%…you’ll stop paying into the pension scheme

- Income Tax @20%…ok, hopefully you’ll have a large enough pension to pay income tax BUT you still get the personal allowance (£12,500 in 2019) so a greater proportion of your income is tax-free.

- EXAMPLE… a teacher going from a salary of £45,000 to a pension of £20,000:

- So instead of dropping £25,000 the actual, in your pocket, drop is more like £11,000

- Salary of £45,000

Taking Early Retirement

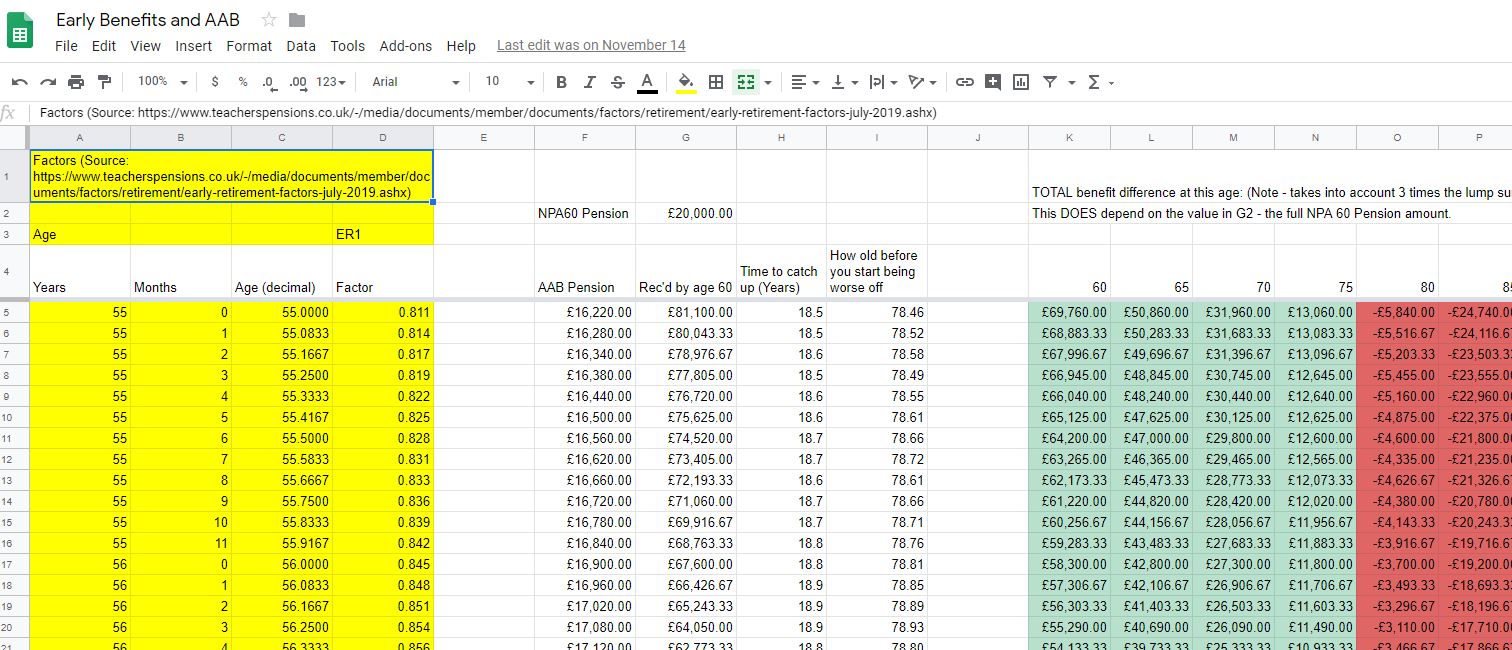

- In both Teacher schemes you can choose take the pension early, from the age of 55. The amount you get is reduced so it is worth understanding how this affects you.

If you take it early you get less per year but you receive it for more years…so there will be years where you are better off and then years where the total amount you will have received falls behind…this table shows the effects on both schemes

For the Final Salary scheme the age at which one overtakes the other is between 78 and 80 (though check out the effect of taking it at 59 and 11 months)

For the Career Average scheme the age at which this happens is between 82 and 85

- If you choose to take early retirement then you HAVE to take both pension schemes at the same time. If you wait to take the Final Salary scheme until your National Pension Age for the scheme (NPA) then you can leave the Career Average scheme until it reaches its NPA.

- TPS – Early Retirement Page

- TPS – Actuarial Adjustment Factors

- (Older factors)

Future Work

If you wait until your NPA to take your teacher’s pension then there are limits on how much you can earn from TEACHING in the future. If you take your pensions early then there are no limits…so if you intend to work in teaching (it has no effect on earning outside of teaching) be aware of how much you can earn before your pension is suspended.

Intend to work again in teaching? Consider taking your pension ‘early’, even by a day or a week. If you do you get a very small reduction (see the table above) but can earn as much as you like from teaching

Stepping Away

Lump Sum Question

If you have benefits in the final salary scheme there is a lump sum (3 times the pension figure) and an option to convert some of the pension to a larger pension – up to 25% of your pension. For this you get 12 times the amount of pension given up…so is it worth it?

- More Lump Sum: 12 times what you give up.

The factors used though are interesting and you should not ignore the effect of tax when doing any calculations. For example you get 12 times what you give up as a lump sum but it is tax-free whereas what you are giving up is, likely, to be taxed at 20% so you are actually getting, in your pocket, 15 times what you have given up.

That means after 15 years of receiving your pension you reach the point where you start to fall behind in terms of the total amount of money received.

To ‘win’ then your lump sum needs to generate more than the amount given up, i.e. 1/12th of the lump sum. That is 8.3%…above inflation, so for this year where inflation is at 1.7% you would need a return of 10%…and that needs to be after tax…so getting on for 12% before tax.

This is a bit simplistic because of course you also have the lump sum ‘in the bank’.For many people being mortgage and debt free gives them greater peace of mind and so take a larger lump sum to do this.

- More Pension

It isn’t strictly possible to go the other way and turn your lump sum into extra index-linked pension but there is a way to do it if you have money to spend before you retire. You can buy additional pension for a lump sum.

The cost depends on your age, the basic £250 costs a 60 year-old £5200, but they only pay 80% as you get tax-relief which means it’s more like £3800 – recouped in 19 years. A 50 year-old could buy this for £4160 (~£3330 after tax-relief)…but then they have to wait longer to get it so would also lose the interest they could have been getting on that £3330.

There are other questions that this simple comparison in cash and time terms can’t answer, here are a few to consider:

- The effect of inflation – the lump sum will be eroded by it, the pension – being index-linked – is not affected

- Your ‘worth’. The lump sum becomes part of your estate whereas when you die the pension (apart from survivor benefits) stops, the lump sum would be passed on to your beneficiaries.

- Your ‘worth’…I know it’s the same as above but consider future care costs. At the current time the state provides home care costs based on means-testing. If you have assets of more than £23,250 then you have to pay…and with care home costs upwards of £700 a week your lump sum won’t go that far whereas your pension is paid for life.

Loss of structure

Having spent our working lives in a setting where every minute is planned and goverened by ‘the bell’ it can be very strange to have unstructured time to do whatever needs to be done. Bizarrely it was our dogs that were most upset by the changes in our routine so whilst we now have complete freedom to do what when we want we adopted a pretty set routine for our daily activities. That and going back to the basics of dog training worked well for us.

Freedom and Responsibility

There are numerous opportunities to take on more social responsibilities. We took on roles in our local village and with the extra time were also able to take on new interest such as bee-keeping.

Stepping Forward

…no crystal balls can be found here but the index-linked pension does give us some protection against future financial uncertainties.