Your employer is allowed to deny permission for you to take “early” retirement for up to 6 months….is that for real?

There is a rule that says that if you are applying for “early” retirement then your employer has to “agree”.

A first sight the rule appears to be rather punitive, but once you drill down into the detail there is a “get out” clause and it is only when you understand why the rule was conceived in the first place does it even make any sense at all.

Your employer is entitled to withhold their permission for up to 6 months.

However, the “get out” clause is exactly as it sounds. Their denial of permission only lasts for as long as you are employed by them.

Their blocking of your application ends on the very last day of your employment, though you must have given the TPS at least 6 weeks notice.

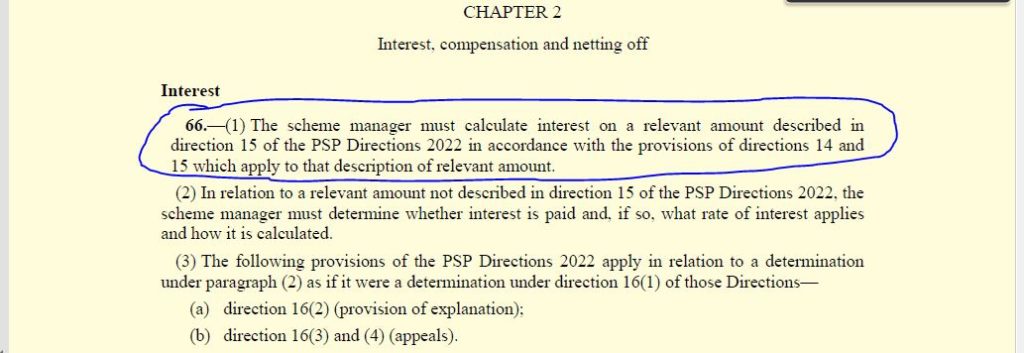

Regulation 12(3)(b) under Schedule 7 (Case E: early retirement):

(b) where P ceases to be in that employment before 6 months have expired since the date on which P asks P’s employer to agree, such day as P specifies in the application, which must be no earlier than 6 weeks after the date on which P’s application is made.

https://www.legislation.gov.uk/uksi/2010/990/made/data.pdf

The rationale for this rule’s inclusion is that the pension scheme is not allowing a teacher to get around their contract of employment and take their pension whilst still “employed”.

A teacher has to give a minimum of 3 months notice to leave their employment and this rule is designed to prevent a teacher walking out of their contract and taking the pension immediately.

So, yes, taking the pension “early” requires you get the permission from your employer, but so long as you ASK for it, and apply for the pension, at least 6 weeks before the end of your employment contract it doesn’t matter if they give or deny you that permission since your pension will be paid on the first day after leaving employment so long as you have given the required notice to resign your employment.