A calculator to help you find how much you can receive from your pension if you have taken it at, or later than, your normal pension age.

Pension Age Changes

The Teaching pension schemes are no strangers to changes in the pension age at which they are designed to be taken.

Before 2007 it was 60, then 65 and more recently has been brought into line with the state pension age. What is also changing is the MINIMUM pension age – the age at which you can, with a reduction, take the pension.

The GOOD news is that as the legislation stands the final salary schemes, those that teachers were in before 1 April 2015, retain the pension ages as they were – no real surprise there as that was the contractual obligation, teachers will get what they signed up and paid for.

The BAD news is that the newer, career average, scheme was written differently and so IS subject to the change. If you are not 55 before 6 April 2028 then you won’t be able to access this part of the pension until you reach 57. Also, the plan is to raise this further in the future to 58 and for it to then track 10 years behind the state pension age. Remember though that taking it 10 years early does mean you will be paid less to make up for the fact you will be paid it for longer.

Pay Rise 2022 – Good Or Bad for the Pension?

A 5% pay rise versus double-digit inflation…what is best for your pension?

Transfer Out Calculator

If you have been in the TPS for LESS than 2 years you can transfer it to a private pension scheme. This calculator works out the transfer value (and it’s a lot more than getting a refund of your contributions!)

Transfer OUT of the TPS

Less than 2 years in the TPS?

With less than 2 years you CAN get a refund of your contributions…this video looks at why that may not be your BEST option

Get into teaching

Transferring your private pension into the Teachers’ Pension Scheme when you start teaching may give you a better annual pension than buying an annuity…if you live long enough to enjoy it

Transfers IN

You have 12 months from starting, or re-entering, pensionable service to transfer other pensions in to the TPS. But is it worth it?

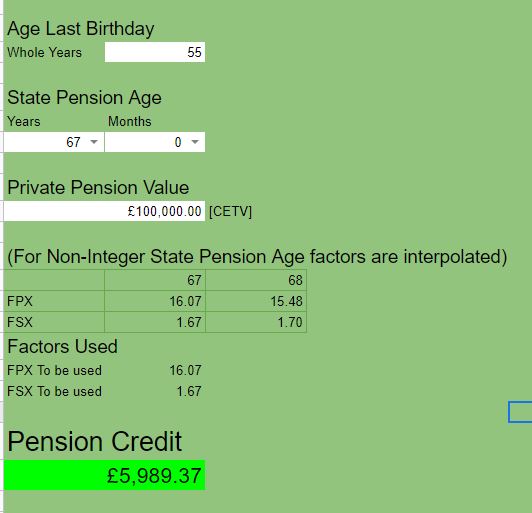

The value depends on two age;

- Your age now

- Your state pension age

This sheet will let you work out how much career average pension would be added if your transferred a lump sum from another private (defined contribution) scheme.

Ill Health Calculator – Career Average Scheme

Ill-health retirement can now only be taken whilst in the career average scheme. This calculator, after you’ve made a copy of it, lets you put in your figures to see how much pension you would receive from each of the two tiers of ill-health retirement.

Selling the Golden Goose?

Pension for sale…£1 for £12

A question to which there are as many answers as their pensioners….and no-one has convinced my one way or the other…so I opened another spreadsheet.

The sheet I used: https://bit.ly/3PzqC9e

Successful Bits

Ok, so this is a bit of self-indulgent navel gazing where I intend to reflect on campaigns and other stuff that I feel might have made a difference.

Facebook Group

https://www.facebook.com/groups/230186658803343/

I started a “Teacher to Teacher” self-help group in 2020, as of today in May 2024 there are over 15,000 teachers in the group, helping each other navigate the peculiarities of the TPS. The group has also helped put pressure on the administrators to clarify what is meant in some of their communications.

YouTube Channel

Many aspects of the TPS can be confusing and so I set about producing videos to “explain” them more clearly. The channel now has over 40 such videos and more are planned.

https://www.youtube.com/@dfountain

Pay Freeze Pension Consequences

The Pay Freeze pension implications. Back in 2020 I became aware of the implications for pensions of the rule used to calculate the final salary that only re-valued salaries from the date of a change in pay. The briefing document was taken up by the main unions and has been discussed at the DFE and the Pension Board. Many authorities are now taking action to ensure teachers do not lose out twice during pay freezes.

Links to areas confirmed:

- Cumbria

- Essex

- Oxfordshire

- Bradford

- Gloucestershire

- Norfolk

- Wandsworth

- NEU Statement

- NASUWT Statement and Sample Letters

- Sefton, Merseyside (No link yet)

Case Studies on TPS

Case studies published on the TPS website were misleading and had significant mathematical errors that over benefitted the newer Career average scheme. Challenges to these through the TPS facebook page led to the case studies being withdrawn and re-worked with *slightly* better scenarios – though still with scenarios that unduly flattered the career average option (teachers in the NPA60 scheme working until 65 etc).

Career Average Pension Calculator

The TPS website has many useful calculators but one in particular caused me major concern. The career average calculator included assumptions on future inflation and factored those into the results. Using inflation itself wasn’t a problem but the resulting ‘pension’ then lacked any context. I pointed out, repeatedly, that it was no good being told that you’d be getting a pension in 40 years time of £110,000 a year if you didn’t know how much a loaf of bread was going to cost in 40 years time. The calculator has had the inflation element removed.

Teacher Knowledge

With over a decade of below inflation pay rises and the ending of the final salary scheme there has never been a better time for teachers to be made aware of how the rules can work in their favour. In particular the hypothetical calculation can now be used much more sympathetically. The main successes in this area has been where I’ve worked through the figures with teachers desperate to leave who didn’t realise that breaks they’d had back many moons ago would result in their pensions being significantly (up to 24%) higher than was being shown on their statements.