Is your final salary pension about to fall over a cliff and lose some of its value?

The scheme end on 31 March 2022 but continues to use salaries from the last 10 years and those into the future. Your pension can go down if you are not careful

Reflections on reaching for retirement

Is your final salary pension about to fall over a cliff and lose some of its value?

The scheme end on 31 March 2022 but continues to use salaries from the last 10 years and those into the future. Your pension can go down if you are not careful

The remedy period (1 April 2015 to 31 March 2022) is where each eligible teacher gets to choose which scheme it is counted in, either their original final salary scheme or the new career average scheme.

TPS produced some case studies that, in my opinion, appeared to have been designed with the intention to promote the new career average scheme and minimise the differences between the schemes rather than what should have been their primary purpose; to help members of the scheme identify with the examples and so improve their understanding of what is likely to happen to their pensions.

To this end I have created several case studies of my own that, again in my opinion, more closely resemble real cases. The first 3 of these are all based on a typical classroom teacher who reaches the top of the upper pay range and stays there until the end of their career.

In these cases all the teachers are looking to retire at 60 and take all of their pension at that time. This means that any career average pension will be actuarially reduced but this makes the comparison between the choices each member will be given much easier to make.

The three case studies are for;

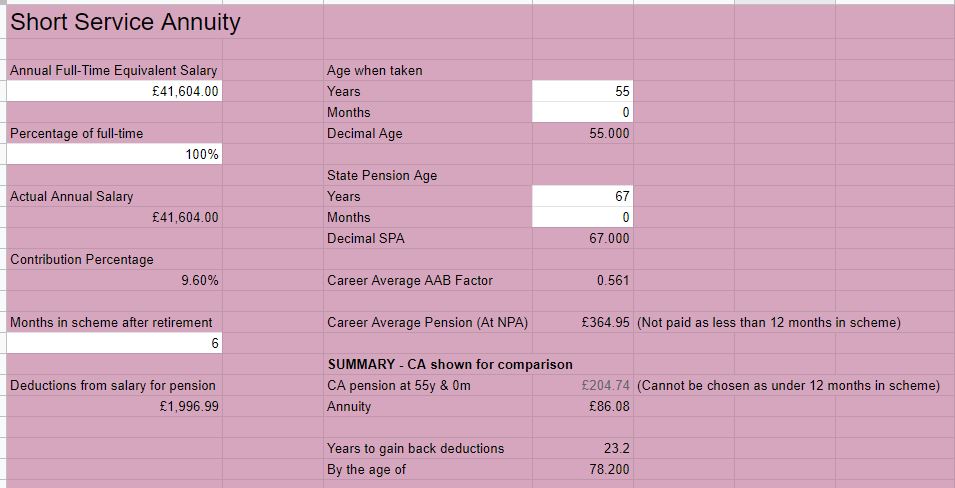

With the call going out to retired teachers to return to the classroom many have concerns about whether contributing to the pension scheme will give them value for money or not – particularly if they are going to be teaching for less than 1 year.

If they teach for more than a year then the career average scheme, that anyone who has already started taking their pension would be in on their return to teaching, normally pays back their contributions in under 10 years.

The pay back period for the short service annuity for anyone under 75 exceeds 13. So definitely not as good value as the actual pension.

https://docs.google.com/spreadsheets/d/1a-EmG1ByyhqvZG355CaJDCvwRzwtwhn9e20IRUUY14o/edit?usp=sharing

To work out how much you get to take home after pension, national insurance and income tax has been deducted.

Why you should NOT start your pension on the very first day you can…unless your birthday matches that day…

60+ and still teaching?

The end of the final salary scheme on 1 April 2022 presents you with an opportunity to take your final salary pension, continue working AND get paid more.

“Golf cake” by Eldriva is licensed under CC BY-ND 2.0. To view a copy of this license, visit https://creativecommons.org/licenses/by-nd/2.0/?ref=openverse&atype=rich

Or is it…

The final salary scheme can no longer be added to after March 2022 but that doesn’t mean the end…your future salaries will still be used in working out the pension – so make sure you know how to get the most out of that!

When can I get my hands on the pension?

In this video I look at the confusion surrounding the changes to the state pension age and the minimum ages that you can access your teachers’ pension

https://bills.parliament.uk/bills/3032

The start of the legislation needed to implement the remedy to the age discrimination caused by the transition from Final Salary to Career Average pension schemes.

If you are over 60 and haven’t already started taking your pension you would suffer from abatement if you took it all. However, taking phased retirement benefits does not lead to abatement.

You could work a day less and get paid more than you are now.

Proudly powered by WordPress | Theme: Baskerville 2 by Anders Noren.