Or is it…

The final salary scheme can no longer be added to after March 2022 but that doesn’t mean the end…your future salaries will still be used in working out the pension – so make sure you know how to get the most out of that!

Reflections on reaching for retirement

Or is it…

The final salary scheme can no longer be added to after March 2022 but that doesn’t mean the end…your future salaries will still be used in working out the pension – so make sure you know how to get the most out of that!

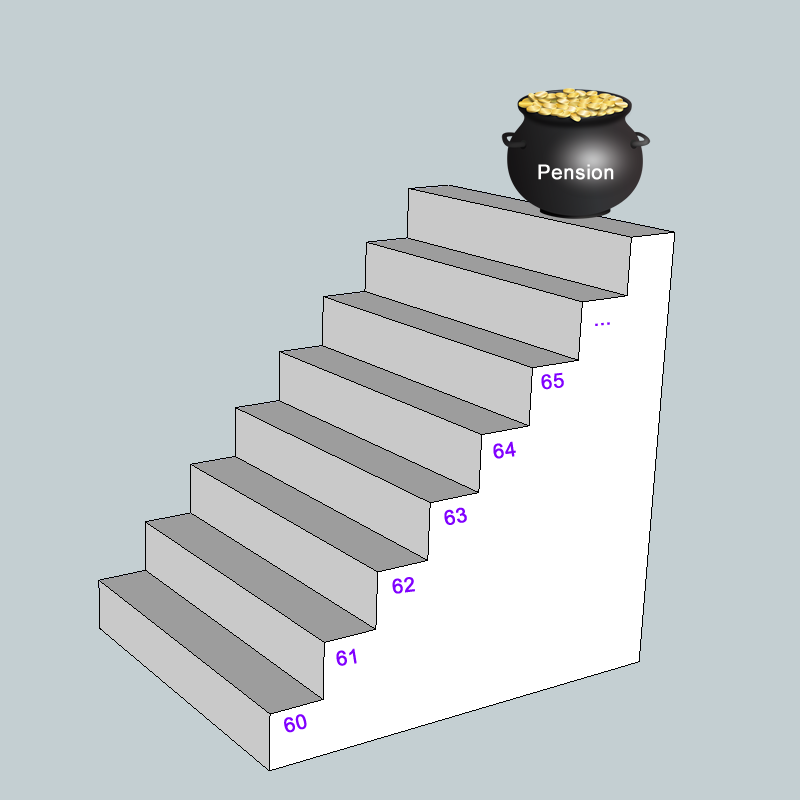

When can I get my hands on the pension?

In this video I look at the confusion surrounding the changes to the state pension age and the minimum ages that you can access your teachers’ pension

https://bills.parliament.uk/bills/3032

The start of the legislation needed to implement the remedy to the age discrimination caused by the transition from Final Salary to Career Average pension schemes.

If you are over 60 and haven’t already started taking your pension you would suffer from abatement if you took it all. However, taking phased retirement benefits does not lead to abatement.

You could work a day less and get paid more than you are now.

If you retire at your Normal Pension Age and carry on, or return to, working then your pension may be abated (cut!).

Here I explain why and how to avoid it.

You want more?…

There are three ways to put more into your pension and to get more out of it. This presentation looks at the relative costs of Faster Accrual compared to Additional Pension.

Retiring next year, or in 30 years – the pay freeze could bomb your pension.

Fix it for £1

My abridged version of the Government’s response to the consultation on the removal of age discrimination in the public sector pension schemes.

For my own reference but I’m posting it as others may also find it useful. I have reduced it to the main points, focusing solely on the actions the Government is proposing to take.

I removed details on who responded to the consultation and the summaries of their contributions to boil it down to just what is proposed will happen without so much of the why it will happen.

The Full Proposal (72 pages)

The McCloud judgement declared that the transition of public sector pensions introduced in 2015 was illegal. This explains the relevance to the Teachers’ Pension schemes.

A budget planner that looks at ‘front-running’ a SIPP, or AVC, before taking your pension.

By using the tax-relief and your personal allowance this sheet can help you see what the effects are on your finances of taking the Teacher’s pension later than 55 and instead using a private pension to plug the gap between 55 and when you are ready to take it.

Proudly powered by WordPress | Theme: Baskerville 2 by Anders Noren.