Had a quick run through and there’s only one difference relevant to teachers from the proposed consultation that I have found.

A.45: Regarding the early-buy-out flexibility. It had been proposed that it just be cancelled with the purchase costs being returned to members, minus tax. The suggestion now is that may be unfair and so more discussions about possible alternatives will take place. i.e. to give members a choice to have a refund (less tax), or convert to another pension element such as ‘additional pension’.

My other notes:

The word “generous” is used extensively in the report, feeding in to a narrative that is often used to attack this aspect of teacher’s pay and conditions. It may be another story but it just grates…that and the references to how the “burden” of paying falls on the ‘taxpayer’ – of course it does, unless you expect people to work for nothing.

A lot of references to tax differences are, in the main, irrelevant to teachers because the levels of contributions taken from teachers was the same no matter which scheme they were/are in.

The mechanism for allowing members to choose must be in place by 1 October 2023 but schemes could do it sooner. The TP scheme I believe to be a simpler conversion than other public sector schemes so could well be one to do it sooner. The annual statement will include details on what benefits would be paid under each choice.

At the point of choice any back-dated amounts would be paid as a lump sum and be taxed on the day they are paid…however, if this means it would involve paying a higher tax rate than would have been the case had they been paid previously then members can apply to HMRC to have the tax calculated as such. This seems reasonable but does put an emphasis on the teacher checking whether this has happened and then having to take action rather than it being resolved automatically. It would, imo, be a small number of cases where the difference would raise a pension into the higher tax band, currently £50,000…there may be more who have pensions below the minimum level though, currently £12,500, who may also need to do this.

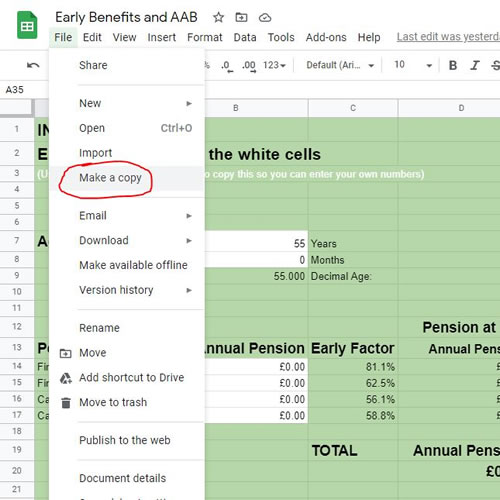

The main point is about ‘when’ to make a choice. This is at the time benefits are applied for so at such time the values of each choice will be known and members will not have to guess which would be the best for them.

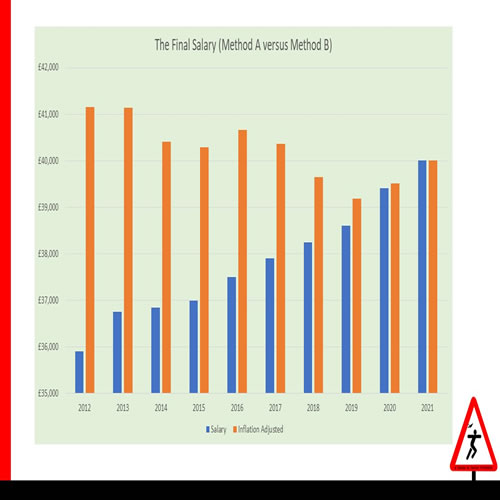

One possible contentious phrasing relates to the qualifying break. There is a difference of 1 day in the scheme and the proposal. The scheme is that a break of more than 5 years breaks the link between schemes whereas the proposal states “less than 5 years”. An exact break of 5 years therefore could be construed differently. Clarification will be needed on this and I have written to the Treasury to raise this..

Contingent decisions. Members who made decisions based on the introduction of the Career Average scheme and who now regret it can make a claim to revisit that decision and subsequent consequences. However, the onus will be on the member to prove their decision was so influenced and any restitution would include their having to pay any missing contributions…this also has implications for the employer who would also have to pay the related contributions for that member (i.e. the 23% employer contribution, or whatever rate was in effect at that time). Plus interest.