You want more?…

There are three ways to put more into your pension and to get more out of it. This presentation looks at the relative costs of Faster Accrual compared to Additional Pension.

Reflections on reaching for retirement

You want more?…

There are three ways to put more into your pension and to get more out of it. This presentation looks at the relative costs of Faster Accrual compared to Additional Pension.

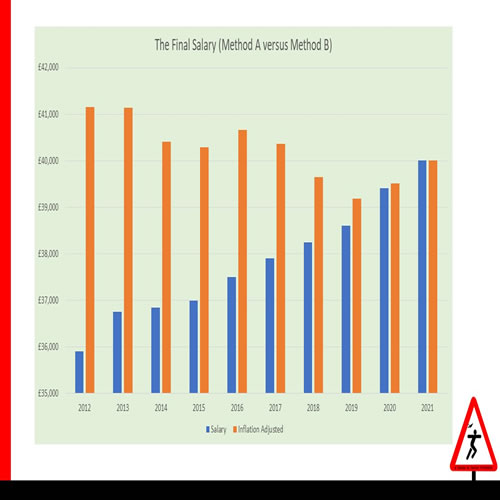

One method (method B) used to calculate your final salary looks at your last 10 years salaries.

These are revalued using inflation, which often makes them worth more than you are currently earning!

When teachers have periods of pay freezes and below inflation pay rises this method often produces a better final salary pension calculation.

This spreadsheet will let you enter your last 10 year’s salary figures and to check what is going to happen over the next few months and years to your Final Salary Pension. If it is going to drop then you should seek advice on whether opting out would be appropriate.

Retiring next year, or in 30 years – the pay freeze could bomb your pension.

Fix it for £1

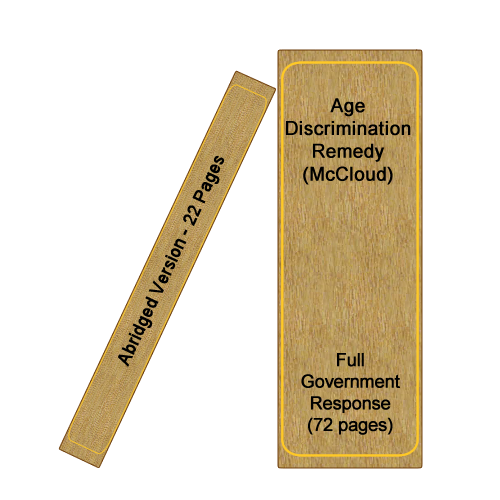

My abridged version of the Government’s response to the consultation on the removal of age discrimination in the public sector pension schemes.

For my own reference but I’m posting it as others may also find it useful. I have reduced it to the main points, focusing solely on the actions the Government is proposing to take.

I removed details on who responded to the consultation and the summaries of their contributions to boil it down to just what is proposed will happen without so much of the why it will happen.

The Full Proposal (72 pages)

The McCloud judgement declared that the transition of public sector pensions introduced in 2015 was illegal. This explains the relevance to the Teachers’ Pension schemes.

Is “Average” a dirty word, and is the Career Average Pension worth it?

A budget planner that looks at ‘front-running’ a SIPP, or AVC, before taking your pension.

By using the tax-relief and your personal allowance this sheet can help you see what the effects are on your finances of taking the Teacher’s pension later than 55 and instead using a private pension to plug the gap between 55 and when you are ready to take it.

Had a quick run through and there’s only one difference relevant to teachers from the proposed consultation that I have found.

A.45: Regarding the early-buy-out flexibility. It had been proposed that it just be cancelled with the purchase costs being returned to members, minus tax. The suggestion now is that may be unfair and so more discussions about possible alternatives will take place. i.e. to give members a choice to have a refund (less tax), or convert to another pension element such as ‘additional pension’.

My other notes:

The word “generous” is used extensively in the report, feeding in to a narrative that is often used to attack this aspect of teacher’s pay and conditions. It may be another story but it just grates…that and the references to how the “burden” of paying falls on the ‘taxpayer’ – of course it does, unless you expect people to work for nothing.

A lot of references to tax differences are, in the main, irrelevant to teachers because the levels of contributions taken from teachers was the same no matter which scheme they were/are in.

The mechanism for allowing members to choose must be in place by 1 October 2023 but schemes could do it sooner. The TP scheme I believe to be a simpler conversion than other public sector schemes so could well be one to do it sooner. The annual statement will include details on what benefits would be paid under each choice.

At the point of choice any back-dated amounts would be paid as a lump sum and be taxed on the day they are paid…however, if this means it would involve paying a higher tax rate than would have been the case had they been paid previously then members can apply to HMRC to have the tax calculated as such. This seems reasonable but does put an emphasis on the teacher checking whether this has happened and then having to take action rather than it being resolved automatically. It would, imo, be a small number of cases where the difference would raise a pension into the higher tax band, currently £50,000…there may be more who have pensions below the minimum level though, currently £12,500, who may also need to do this.

The main point is about ‘when’ to make a choice. This is at the time benefits are applied for so at such time the values of each choice will be known and members will not have to guess which would be the best for them.

One possible contentious phrasing relates to the qualifying break. There is a difference of 1 day in the scheme and the proposal. The scheme is that a break of more than 5 years breaks the link between schemes whereas the proposal states “less than 5 years”. An exact break of 5 years therefore could be construed differently. Clarification will be needed on this and I have written to the Treasury to raise this..

Contingent decisions. Members who made decisions based on the introduction of the Career Average scheme and who now regret it can make a claim to revisit that decision and subsequent consequences. However, the onus will be on the member to prove their decision was so influenced and any restitution would include their having to pay any missing contributions…this also has implications for the employer who would also have to pay the related contributions for that member (i.e. the 23% employer contribution, or whatever rate was in effect at that time). Plus interest.

I threw away £8,000 and to make it worse, continue to throw another £2,000 away every year. Learn how to use a little known rule to protect your pension.

https://www.youtube.com/watch?v=sFGJbmtMQHQ

Service to break 6 years, service after break 7 years.

Salary at break: £40,000.

Salary at end: £32,000.

End is LOWER than Break = Restricted

1) Break calculation: 6 years / 80 x £40,000 = £3,000 (then inflation is added, say 7 years @2%=~15%) £3,000 + 15% = £3,450.

2) End calculation: 13 years / 80 x £32,000 = £5,200

The best of these is £5,200, so that is what is received.

Service to break 6 years, service after break 7 years.

Salary at break: £40,000.

Salary at end: £44,000.

End is HIGHER than Break = Unrestricted

1) Break calculation: 13 years / 80 x £40,000 = £6,500 (then inflation is added, say 7 years @2%=~15%) £6,500 + 15% = £7,475.

2) End calculation: 13 years / 80 x £44,000 = £7,150

The best of these is £7,475, so that is what is received.

The hypothetical calculation is made every time you have a break in service and with teacher’s pay failing to keep pace with inflation for more than 10 years – and likely not to do so for quite a few more, it can easily mean that you will get a HIGHER pension than the one shown on your benefit statement. The problem is that TPS routinely REFUSE to tell you how much this calculation would give you.

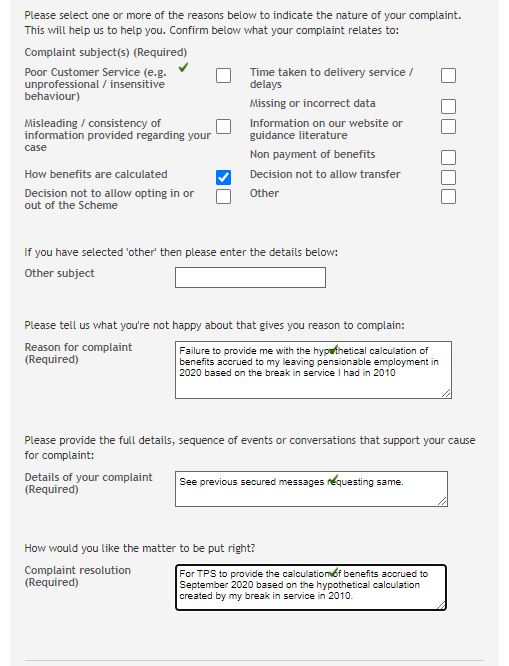

One teacher I’ve been chatting with recently finally managed to get a successful conclusion by submitting a formal complaint. This is a paraphrased account of what happened:

Teacher to TPS: Please could you confirm what my pension will be based on the break in service I had in 2010

TPS to Teacher: Thank you for your secure message. I should explain that we do not provide hypothetical estimates of benefits. These calculations are only performed at retirement when a completed application for benefits has been received. I am sorry for any inconvenience this causes.

Teacher to TPS: Via complaint form

TPS to Teacher: Within the week a statement detailing the hypothetical calculation was provided for the teacher. The amount from this calculation was in the region of 10% higher than that he had been given previously

The final salary calculation has two parts – the obvious part, i.e. the last 12 month’s worth, but also another calculation – this explains both.

Proudly powered by WordPress | Theme: Baskerville 2 by Anders Noren.