https://bills.parliament.uk/bills/3032

The start of the legislation needed to implement the remedy to the age discrimination caused by the transition from Final Salary to Career Average pension schemes.

Reflections on reaching for retirement

https://bills.parliament.uk/bills/3032

The start of the legislation needed to implement the remedy to the age discrimination caused by the transition from Final Salary to Career Average pension schemes.

If you are over 60 and haven’t already started taking your pension you would suffer from abatement if you took it all. However, taking phased retirement benefits does not lead to abatement.

You could work a day less and get paid more than you are now.

Contracted Out

Up until 2016 Teachers were ‘contracted out’ of the additional state pension and so many do NOT qualify for the full NEW state pension…I explain.

If you retire at your Normal Pension Age and carry on, or return to, working then your pension may be abated (cut!).

Here I explain why and how to avoid it.

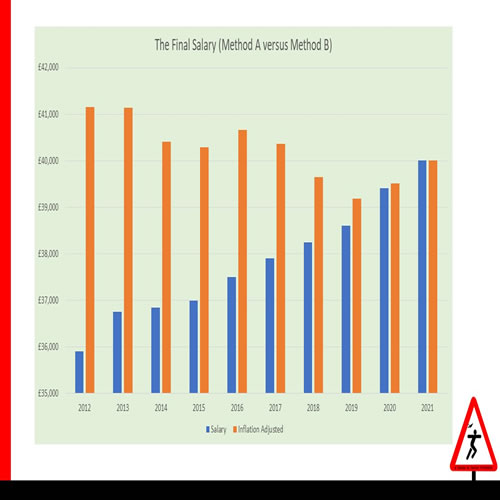

Retiring next year, or in 30 years – the pay freeze could bomb your pension.

Fix it for £1

I threw away £8,000 and to make it worse, continue to throw another £2,000 away every year. Learn how to use a little known rule to protect your pension.

https://www.youtube.com/watch?v=sFGJbmtMQHQ

Service to break 6 years, service after break 7 years.

Salary at break: £40,000.

Salary at end: £32,000.

End is LOWER than Break = Restricted

1) Break calculation: 6 years / 80 x £40,000 = £3,000 (then inflation is added, say 7 years @2%=~15%) £3,000 + 15% = £3,450.

2) End calculation: 13 years / 80 x £32,000 = £5,200

The best of these is £5,200, so that is what is received.

Service to break 6 years, service after break 7 years.

Salary at break: £40,000.

Salary at end: £44,000.

End is HIGHER than Break = Unrestricted

1) Break calculation: 13 years / 80 x £40,000 = £6,500 (then inflation is added, say 7 years @2%=~15%) £6,500 + 15% = £7,475.

2) End calculation: 13 years / 80 x £44,000 = £7,150

The best of these is £7,475, so that is what is received.

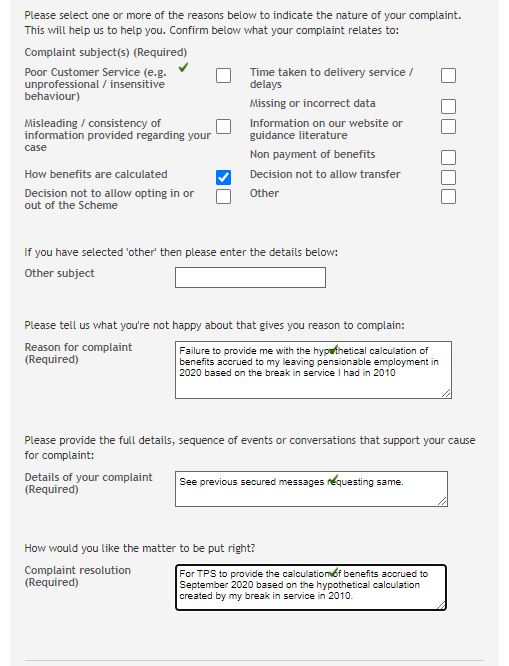

The hypothetical calculation is made every time you have a break in service and with teacher’s pay failing to keep pace with inflation for more than 10 years – and likely not to do so for quite a few more, it can easily mean that you will get a HIGHER pension than the one shown on your benefit statement. The problem is that TPS routinely REFUSE to tell you how much this calculation would give you.

One teacher I’ve been chatting with recently finally managed to get a successful conclusion by submitting a formal complaint. This is a paraphrased account of what happened:

Teacher to TPS: Please could you confirm what my pension will be based on the break in service I had in 2010

TPS to Teacher: Thank you for your secure message. I should explain that we do not provide hypothetical estimates of benefits. These calculations are only performed at retirement when a completed application for benefits has been received. I am sorry for any inconvenience this causes.

Teacher to TPS: Via complaint form

TPS to Teacher: Within the week a statement detailing the hypothetical calculation was provided for the teacher. The amount from this calculation was in the region of 10% higher than that he had been given previously

The final salary calculation has two parts – the obvious part, i.e. the last 12 month’s worth, but also another calculation – this explains both.

Pensions are a fraction of your salary. (80th, 60th, 57th etc) so does taking a pension mean having to watch every penny…it’s not as big a cut as you may think.

youTube: Poor Pensioners – Just how big a drop in income is it?

One of the biggest myths, or misunderstandings, is that taking the pension ‘early’, as early as 55, LOSES 20% of your pension.

There is some truth to this figure but it is NOT as significant as it first sounds…I explain more here

Proudly powered by WordPress | Theme: Baskerville 2 by Anders Noren.