The final salary calculation has two parts – the obvious part, i.e. the last 12 month’s worth, but also another calculation – this explains both.

Reflections on reaching for retirement

The final salary calculation has two parts – the obvious part, i.e. the last 12 month’s worth, but also another calculation – this explains both.

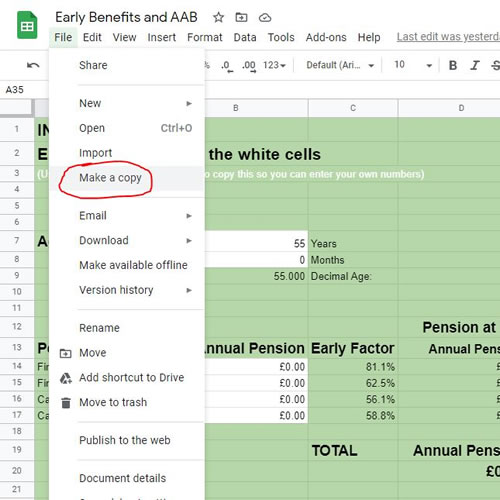

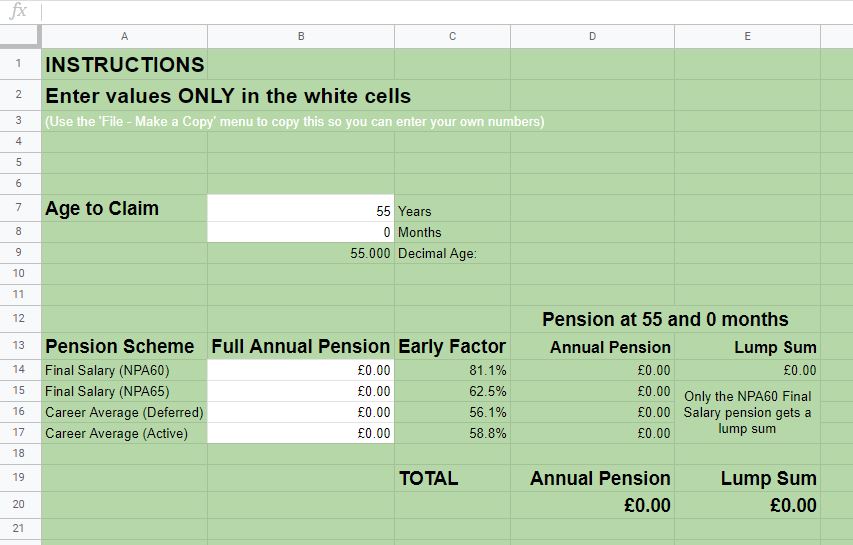

All of my spreadsheets are now collected in one section of the website. These can be copied which allows users to enter their own data and check the formulae.

Could you be owed hundreds of pounds?

If you bought additional pension with a lump sum, quite possibly.

HMRC are not used to dealing with pension schemes that are NOT set up for automatic tax relief.

The relevant HMRC manual page to quote if the first person you talk to doesn’t understand this fully is the 3rd bullet point on this page:

www.gov.uk/hmrc-internal-manuals/pensions-tax-manual/ptm044210

“£60,000 – you must be JOKING…no way am I putting that much into my pension.” You may be shocked!

A teacher’s contribution to their pension is around 10% (twice the normal private pension rate)..so somewhere in the range £3k to £5k per year for a classroom teacher.

Employers have to also put in 28.6% (that’s nearly TEN times the minimum private pension scheme employer’s have to pay).

In addition, defined benefit schemes, such as the TPS have their ‘value’ calculated differently, so you may be surprised at just how much of your £60k Annual Allowance you have used.

Before 2024/25 the allowance was £40k and because of the way inflation is added and not accounted for until the following year quite a few teachers exceeded the £40k allowance in 2023 when inflation of 10.1% was added.

Not convinced you should take the pension at 55?

There are other options that will allow you to delay opening your teacher’s pension pot.

Pensions are a fraction of your salary. (80th, 60th, 57th etc) so does taking a pension mean having to watch every penny…it’s not as big a cut as you may think.

youTube: Poor Pensioners – Just how big a drop in income is it?

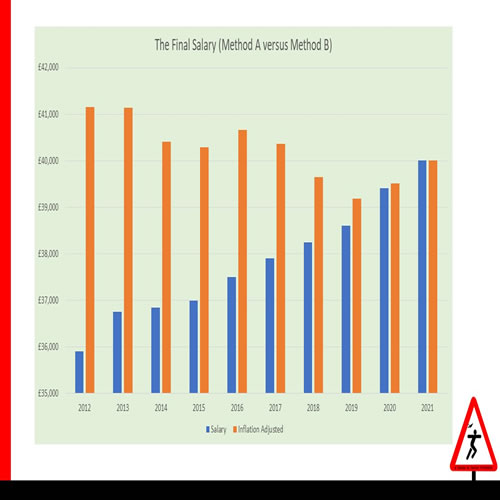

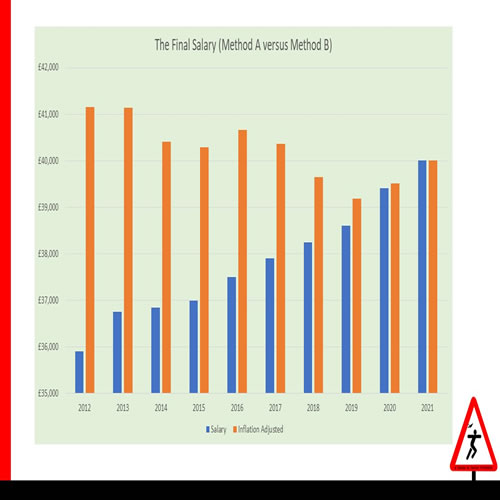

One of the biggest myths, or misunderstandings, is that taking the pension ‘early’, as early as 55, LOSES 20% of your pension.

There is some truth to this figure but it is NOT as significant as it first sounds…I explain more here

Proudly powered by WordPress | Theme: Baskerville 2 by Anders Noren.