After hearing again, for the umpteenth time, that you MUST have a break in employment to take the final salary pension I decided to put the answer here.

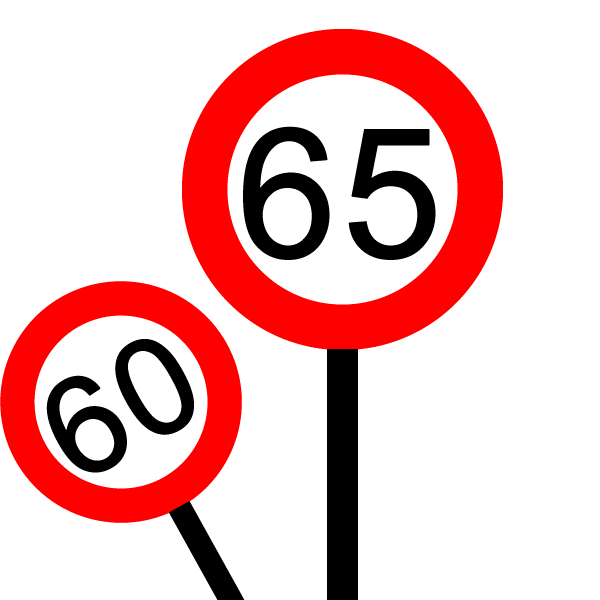

UNDER 60 (Final Salary scheme started before 2007)

Yes, to take this pension “early” you MUST have a break in employment.

60 or OVER

For the NPA60 scheme you do NOT need a break in employment, what you need is a break in “pensionable employment” and these are not the same thing. You can create such a break without leaving employment simply by opting out of the pension. You can, of course, create a break by leaving employment but you don’t have to.

THE REGULATIONS

https://www.legislation.gov.uk/uksi/2010/990/made/data.pdf

Schedule 7 – Retirement Benefits

Regulation 2:

2.—(1) Where a person (P) satisfies the condition for retirement, the entitlement day for Case A is—

(a) if P is not in pensionable employment on the day on which P reaches the normal pension age in relation to the reckonable service, the day on which P reaches that age, and

(b) if P is in pensionable employment on the day on which P reaches the normal pension age in relation to the reckonable service, the day after P ceases to be in pensionable employment.

Part 2 – Pensionable employment

Regulation 7 paragraph 3

(3) A person who makes an election under regulation 9 (election for employment not to be pensionable) is not in pensionable employment while the election has effect.

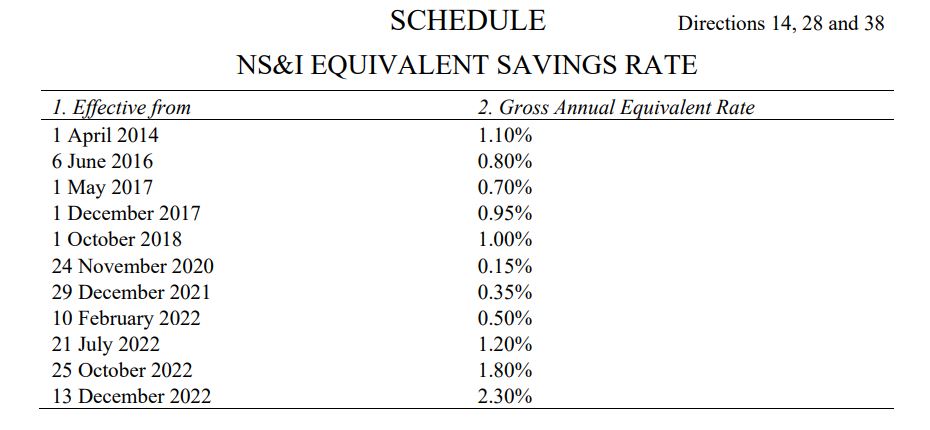

Images of the Application Form

These images taken from the application form, for “normal age” retirement also make it clear that it is sufficient to opt out, without leaving your employment, if you will reach the normal pension age and wish to take the pension.